The Ethereum (ETH) market has shown enormous growth in the last two years. It had a sharper uptrend and set a new all-time high last year. Despite getting less attention, it continued to be one of Bitcoin’s strongest rivals.

The thing is, it could have further expanded and taken advantage of its untapped potential. But before the year started, it crashed in anticipation of macroeconomic changes. It does not seem to have coped with these yet as prices remain erratic.

Uncertainties still hound the market amid corrections and disturbances. But traders and analysts are firm with their hopes for a better year ahead.

The Parabolic Growth of Ethereum

The Ethereum market had immense growth amidst the unpredictable economic conditions in 2020. Like in most capital markets, the COVID-19 pandemic opened more avenues to sustain its highflying price. With a two percent daily increase, the value of a single ETH rose by more than five times in only a year. From $131 on January 1, 2020, the year ended with fruitful results at $737.

The uptrend continued with a nearly 750 percent return. Its price and market value broke $4,000 and $100 billion, respectively. Even so, ETH did not receive much attention, unlike its other siblings, such as Bitcoin (BTC), Ripple (XRP), and Litecoin (LTC). But after its pullback during the financial market correction, it has become another crowd favorite.

The biggest contributor to its parabolic increase was the popularity of Decentralized Finance (DeFi). The Ethereum market hosted many DeFi projects, fueling its growth.

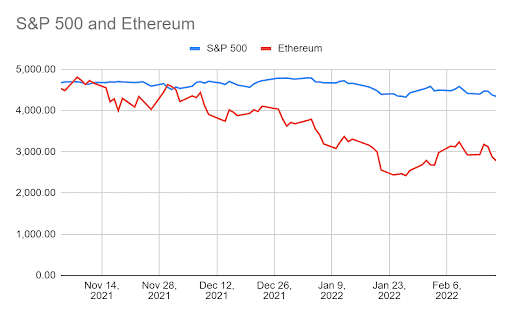

In the same analysis, experts found that ETH had a 64 percent positive correlation with the S&P 500. So, the changes in these stock indexes have a substantial impact. It started to outpace many of its peers and became a safer and more predictable investment option.

What’s Pulling ETH Down?

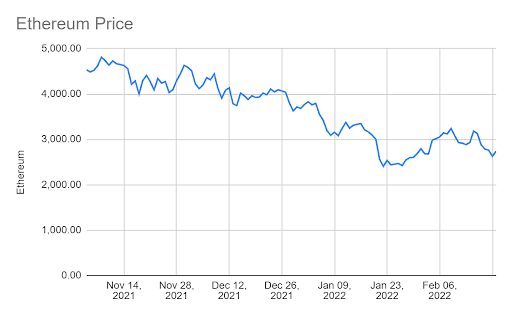

ETH set a new all-time high at $4,812 in early November. Then, a downtrend started afterward, which persisted for eight weeks. Initially, we thought it started to spike on January 10, as prices seemed to recover slowly. But it went into a downward spiral and did not meet the projection of the Economy Watch.

On January 26, things did not get better as price decreases continued to wipe out wealth. ETH lost 30 percent of its value, plunging to $2,468. Its price seemed to recover for the next two weeks, surpassing $3,000 and giving a rebound rate of 24 percent.

Taken from Yahoo Finance

Even so, ETH remains erratic, given another recent downtrend. Currently, it is at $2,739 with no promises of continued increase. Here are some factors that are causing its fluctuations.

Macroeconomic and Political Changes

When the economy reopened, the labor market and the aggregate demand rebounded. It was no surprise then that the inflation rate rose to 7 percent, the highest in 40 years.

In response, the Federal Reserve (The Fed) declared its plan to raise interest rates. Thus, many saw increased savings and lower demand and investments. Selloffs in the financial markets became rampant in December 2021 and January 2022.

The political instability in Kazakhstan is also another challenge that the crypto market is facing. As one of the key hubs, its impact has been substantial.

Given the protests, the surge in electricity demand outweighed the supply. This equilibrium hurt BTC mining, which radiated to the whole market. So miners are desperate to hedge prices, intensifying headwinds.

Too Much Leverage

In January, the crypto leverage ratio hit a new all-time high. But as the number of investors taking risks increased, the amount of debt used for purchases skyrocketed. It has become another factor that led to miners hedging against potential price drops.

Just like in the stock market, more investors sold their holdings. In turn, more crypto flooded and reduced the liquidity of the market. Due to leverage and liquidity differences, its toll was more significant than the stock market.

The Impact of the Stock Market

The stock market appears to be intertwined with the crypto market. It is more visible in the correlation between the S&P 500 and Ethereum. Their 64 percent positive correlation shows that an increase in the S&P 500 stocks leads to a 64 percent increase in Ethereum. It has become more evident in the latter part of December 2021.

Both markets show the same patterns. So as the stock market correction continues, Ethereum correction may persist. In February, a 0.3 percent drop in the S&P 500 price is equivalent to a 0.5% drop in Ethereum, proving the precision of their correlation estimation.

Taken from Yahoo Finance

Is There Hope for Ethereum?

Experts warned investors for more pain ahead in a published article on Fortune last month. It appeared to be logical as ETH took another plunge. But we can see that its price has been in an upward pattern since the last week of January.

It may be too early to tell, but it can be its coping mechanism. These are the potential avenues for its rebound this year.

Government Support

Government support is fundamental to the success of businesses and investments. It can help cryptos like Ethereum find a market amid economic changes. For instance, Ethereum contracts are widely accepted in Singapore, its third-largest market. It may extend to private businesses and other ASEAN members.

Digital Transformation

Digital transformation continues to pave the way for the e-commerce and fintech industries. As more online businesses arise, cashless payments continue to expand. And as e-payment apps increase, cryptocurrencies have more chances to penetrate the market.

Payment apps like PayPal, BitPay, and Coinbase Commerce now accept ETH. They open more doors to collaborate with cryptocurrency exchanges.

More business and investment organizations today are open to cryptocurrency transactions. Groups like decentralized autonomous organizations (DAOs) continue to expand their market.

DAOs, in general, are using ETH. So their growth offers more opportunities to ETH. What sets it apart from the rest is its network effect. Its demand in DAOs and their smart contracts are proof of it.

Potential in Other Countries and Regions

There is a broad disparity in the distribution of crypto users across the world. Europe is second with 38 million users compared to Asia with 160 million. And countries in these regions have vast differences in user population. For instance, Russia has 17 million crypto users, while Norway has only 93,000.

Other regions offer more potential to become new crypto hubs. For example, ETH can expand in Oceania with only one million users as the market becomes more popular.

Recent massive capital inflows in South Africa and Nigeria can become another growth catalyst. With an increased number of users, they can also be another crypto hub. If these opportunities match with the emergence of ETH, it can compete with larger and newer cryptocurrencies.

Steps ETH Investors Can Take

Ethereum remains highly volatile, but its correlation with S&P 500 can help reduce its unpredictability. Although its highs do not equate to lower volatility, tracing its patterns appears easier. Its trends can help figure out its direction.

It will be logical to look at the critical events recently. That way, you will get a clue of your short-term positioning.

Ethereum has been in a generally upward pattern since January 27. After its dip on January 22, it started to go back up and is now over $3,000. Given the current price, it will not be easy to tell if it is bound for a more stable movement. But its trend today shows that it has more chances to recover next quarter.

So what now? ETH is higher than its previous dip, but it remains lower than its trend in the past year. It still appears cheaper, so investors can endure if it takes another plunge. With the improvement in the economy, it still has chances to rebound. Analysts remain hopeful for a better year with estimations at $6,600.

Right now, you can treat ETH as a long-term investment. It may decrease again, but it shows potential for future expansion. Its network effect provides advantages to help it outdo its peers. It may not reach its all-time high, but recovery may happen this year.