Amid the continued growth of digital finance, XRP recently announced a new partnership with BBVA , a prominent Spanish bank . Under the agreement, XRP will integrate its digital asset custody technology into BBVA’s crypto services. BBVA already offers Bitcoin (BTC) and Ethereum (ETH) trading and custody capabilities to individual clients, and the addition of XRP will further enhance the compliance and security of these services.

This partnership is seen as a significant step in the XRP ecosystem’s evolution . XRP has long been widely used in cross-border payments, and now, with the participation of the European banking system, its application is gradually expanding to include custody and investment services. This trend not only enhances XRP’s market trust but also prompts investors to consider: Beyond price fluctuations, are there more stable ways to generate returns from digital assets?

In this market environment, QuidMiner cloud mining is gradually gaining attention among investors. Unlike speculation, cloud mining emphasizes passive income and long-term value . Investors simply select the appropriate hash rate contract to continuously generate daily returns on XRP, as well as mainstream cryptocurrencies like BTC, ETH, DOGE, and SOL. The entire process requires no mining equipment purchase or maintenance; the platform manages the computing power. This model not only lowers the barrier to entry but also provides investors with a more transparent profit structure.

How to use Quid Miner cloud mining?

Register an account – It only takes 1 minute to complete the email registration. New users can get a $15 welcome bonus and an additional $0.6 for daily login.

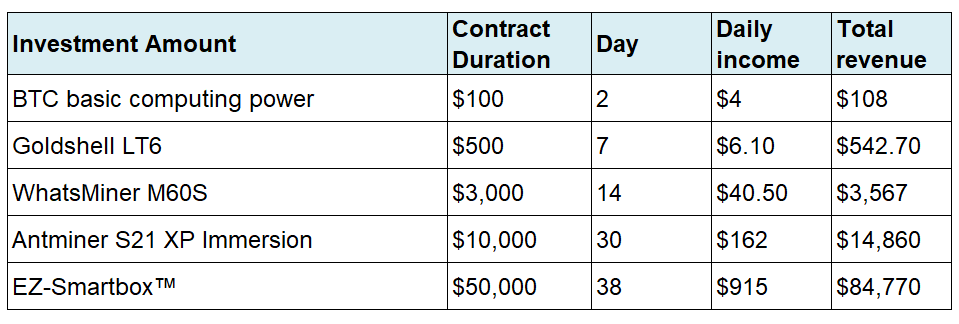

- Choose a contract – The platform offers a variety of short-term and long-term computing power contracts to suit different budgets and goals.

- Complete recharge – Supports mainstream cryptocurrencies such as BTC, ETH, XRP, DOGE, SOL, USDT, USDC, etc.

- System allocation of computing power – the platform automatically allocates computing power, and users do not need to perform additional operations.

- Daily income settlement – income is automatically credited to the account every day and users can view it in real time.

- Free withdrawals – You can withdraw your XRP and USDC at any time , and they are usually received quickly.

Click to view more contract options

Advantages of Quid Miner

- Multi-currency support: compatible with BTC, ETH, XRP, DOGE, LTC, SOL, USDT, and USDC.

- Green Energy: The mine is powered by 100% renewable energy, making it carbon neutral.

- Transparent returns: daily settlement, flexible withdrawals, and no hidden fees.

- Referral Rewards: Invite friends to earn a 4.5% referral reward, up to a maximum of $10,000.

- Global endorsement: Founded in London, UK in 2018, it currently has over 9 million registered users.

- Security: We use McAfee® and Cloudflare® dual protection and provide 24/7 expert support.

- Simple operation: The interface is intuitive and suitable for both novice and experienced investors.

Conclusion

With the launch of XRP’s partnership with BBVA, XRP’s position in the European financial system is steadily increasing. It’s not only a cross-border payment tool, but is also demonstrating new value in banking services. Meanwhile, Quid Miner cloud mining offers investors another path: using hashrate contracts to convert digital assets into stable daily passive income.

This dual drive—XRP’s drive for financial ecosystem expansion and the long-term benefits of Quid Miner cloud mining—is building a more balanced and sustainable digital asset investment framework for investors. In today’s unpredictable market, cloud mining is becoming a key option for bridging stable returns and long-term value.

Quid Miner platform official website: https://quidmining.com/

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency markets are highly volatile, and while platforms like Quid Miner provide structured contracts, returns are not guaranteed. Investors should assess personal risk tolerance and consult with licensed professionals before committing funds.