The decentralized dream of crypto is often clouded by opportunistic projects, and when a token like XA90B surfaces, heavily promoted on platforms like YouTube, investors must exercise extreme caution. While the specific details of XA90B may be difficult to verify through public records—a red flag in itself—its aggressive, spam-like marketing strategy aligns perfectly with several classic warning signs of a potential “rug pull” or “pump-and-dump” scheme.

Here is an analysis of why the heavy, unsolicited promotion of XA90B should be treated as a significant red flag in the volatile crypto presale market.

🚩 Red Flag 1: Aggressive, Unverified YouTube Spam

The most immediate and troubling sign for XA90B is the reported saturation of its promotion across YouTube.

Paid Shills, Not Organic Growth: Legitimate projects gain traction through community engagement, verifiable utility, and expert analysis. Tokens aggressively “spammed” are typically paying non-expert YouTubers, often with undisclosed conflicts of interest, to shill the token. This creates a false sense of hype and urgency.

Focus on Price, Not Product: These videos often focus almost entirely on guaranteed “100x” or “1000x” returns rather than the project’s whitepaper, team, or underlying technology. A robust project sells its utility; a risky one sells hopium.

Lack of Critical Due Diligence: The “reviewers” are often paid to give a positive spin and rarely perform a proper technical or financial audit, failing to address key questions about tokenomics or contract security.

🚩 Red Flag 2: The Fog of Utility and Team

A quick search on XA90B yields minimal credible, third-party information, which points to a lack of transparency—a core pillar of a secure crypto investment.

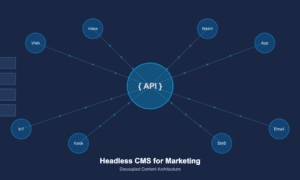

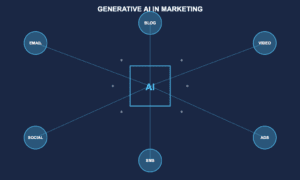

Vague or Non-Existent Utility: What problem does XA90B solve? If the marketing material relies on buzzwords (AI, Metaverse, Web3) without a concrete, deployable use case, it’s likely vaporware designed only to extract presale funds.

Anonymous or Pseudonymous Team: While anonymity is sometimes part of the crypto ethos, projects requesting public funds should have a transparent, doxxed team with verifiable experience. An anonymous team offers zero accountability if the project fails or if a rug pull occurs.

Unaudited Smart Contract: A reputable presale will have its smart contract code publicly audited by a recognized security firm (like CertiK or Hacken). Lack of an audit means the code could contain backdoors, unlimited minting functions, or other exploits that benefit the developers at the expense of investors.

🚩 Red Flag 3: Urgency and Unrealistic Promises

Presale scams thrive on FOMO (Fear of Missing Out), creating intense psychological pressure to invest immediately.

Guaranteed Returns: In the high-risk, high-volatility crypto market, no return is ever guaranteed. Any project promising specific, enormous, and guaranteed profits should be immediately disqualified as fraudulent or highly reckless.

“Limited Time” Offers: The entire presale is often structured to appear as a once-in-a-lifetime opportunity. This urgency is designed to bypass the investor’s critical thinking process, preventing them from doing proper research (DYOR).

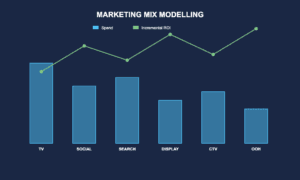

Tokenomics Designed for a Dump: Red flag tokenomics include:

Large Developer/Team Allocations: A huge percentage of tokens reserved for the team that can be dumped on the market after launch.

No Vesting Period: No lock-up period for team tokens, allowing them to sell immediately for a massive profit (the “rug pull”).

🛡️ Investor Takeaway: Do Your Own Research (DYOR)

The emergence of heavily-spammed tokens like XA90B serves as a critical reminder for investors:

If a project has to pay heavily to convince you it’s real, it probably isn’t.

Always prioritize security and transparency over hype. Look for: a verifiable team, a clear and achievable product roadmap, a public and audited smart contract, and organic community support.

The heavy YouTube promotion of XA90B, absent credible public information or verifiable utility, positions it firmly in the high-risk category. Investors should view this aggressive marketing as the primary red flag and avoid the project until substantive, third-party due diligence can confirm its legitimacy.