In the evolving landscape of real estate investment, choosing the right type of property to add to your portfolio is crucial for long-term success. Traditional materials like wood and concrete have been mainstays for decades, but steel structures are rapidly gaining favor among savvy investors. Whether for industrial, commercial, or even residential purposes, steel structures offer a range of benefits that make them a highly attractive investment. In this article, we’ll explore why investing in steel structures could be one of the smartest decisions you make for your real estate portfolio.

The Durability Advantage

One of the most compelling reasons to invest in steel structures is their unparalleled durability. Steel is renowned for its strength and ability to withstand extreme weather conditions, including heavy snow, high winds, and even seismic activities. Unlike wood, steel does not warp, rot, or crack over time. This makes steel buildings a low-maintenance option, reducing the need for costly repairs and ensuring that the property retains its value for many years.

Moreover, steel is highly resistant to pests such as termites, which can cause significant damage to traditional wooden structures. By investing in steel, you eliminate one of the most common risks associated with property maintenance, thereby protecting your investment.

Flexibility and Versatility in Design

Steel structures offer incredible design flexibility, allowing for the creation of large, open spaces without the need for interior columns. This is particularly advantageous for industrial and commercial properties, where open floor plans are often required. Steel’s strength-to-weight ratio is superior to other building materials, enabling architects and engineers to design innovative and functional spaces that meet the specific needs of a wide range of industries.

In addition, steel buildings are easily customizable. They can be expanded or modified to accommodate changes in use or increased space requirements, making them a versatile investment that can adapt to market demands. Whether you need to add more office space, expand a warehouse, or convert an industrial facility into a different type of business, steel structures provide the flexibility to make those changes with minimal disruption.

Faster Construction Times

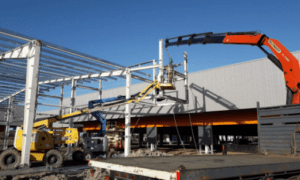

Time is money in real estate, and one of the key advantages of steel structures is the speed at which they can be constructed. Most steel buildings are prefabricated off-site, which means that once the components arrive at the construction site, the assembly process is relatively quick. This not only reduces labor costs but also allows you to bring your property to market faster, thereby generating revenue sooner.

For investors, faster construction times translate to a quicker return on investment (ROI). Whether you’re developing a new commercial property or adding an extension to an existing one, the ability to complete the project in a shorter timeframe can significantly enhance the profitability of your investment.

Sustainability and Eco-Friendliness

As environmental concerns continue to shape the real estate industry, the sustainability of a building material has become a critical consideration for investors. Steel is one of the most sustainable building materials available. It is 100% recyclable, and the steel industry has made significant strides in reducing its carbon footprint through energy-efficient production processes.

Investing in steel structures not only aligns with growing environmental consciousness but also positions your property as a forward-thinking, eco-friendly option in the market. This can be a significant selling point, particularly in sectors where sustainability is a key concern, such as corporate offices, educational institutions, and healthcare facilities.

Cost-Effectiveness Over Time

While the initial cost of steel structures may be higher than that of traditional materials like wood, the long-term cost-effectiveness of steel makes it a smart investment. The reduced maintenance costs, longer lifespan, and lower insurance premiums associated with steel buildings contribute to significant savings over time.

Additionally, the energy efficiency of steel structures can lead to lower utility costs. Steel buildings can easily accommodate modern insulation materials and energy-efficient systems, further reducing operating expenses. For investors looking to maximize their returns, these cost savings can make a substantial difference in the overall profitability of the property.

Resale Value and Market Demand

Steel structures are in high demand across various sectors, from industrial and commercial to residential. The durability, versatility, and sustainability of steel buildings make them attractive to a wide range of buyers and tenants. As a result, properties made of steel often have higher resale values and can command premium prices in the market.

For real estate investors, this means that a steel structure is not just a solid addition to your portfolio; it’s also a property that can appreciate over time, providing you with significant capital gains when it comes time to sell. Furthermore, the flexibility of steel buildings means they can be easily adapted for different uses, broadening the pool of potential buyers or tenants.

Conclusion: A Forward-Thinking Investment

In a competitive real estate market, making informed investment decisions is crucial. Steel structures offer a unique combination of durability, flexibility, sustainability, and cost-effectiveness that make them an excellent choice for investors looking to diversify their portfolios. Whether you’re focused on industrial, commercial, or residential properties, steel buildings provide a forward-thinking solution that meets the demands of modern real estate.

By investing in steel structures, you’re not only securing a property that will stand the test of time but also positioning yourself to capitalize on emerging trends in the real estate market. With their strong resale value, market demand, and long-term cost savings, steel buildings represent a smart, sustainable, and profitable investment for the future.