Two years ago, stablecoins were the elephant in the room. Back then, the one thing that crypto markets were lacking was a reliable asset that could be used as a hedge against market volatility without cashing out into USD. The default option, Tether (USDT), was a source of major controversy and thus appeared many contenders, leading some to call stablecoins the “holy grail” of crypto.

The problem seems to be solved by now, at least in terms of better options. We have stablecoins of all shapes and sizes, with different market shares, trading volumes, and long-term outlooks. Likewise, each one has its own features and implementation models that can create new benefits and profitability options for holders.

At the root of these differences, there are two main approaches that are favored by current markets: fiat-collateralized and crypto-collateralized stablecoins. Both have their advantages and trade-offs, as well as specific nuances when it comes to their implementation. Perhaps the best examples of this are seen in the differences between the established, fiat-collateralized USD Coin (USDC) and a new crypto-collateralized contender, Equilibrium (EOSDT).

Note: There is a third approach known as seigniorage which remains mostly experimental and has little market traction as of yet.

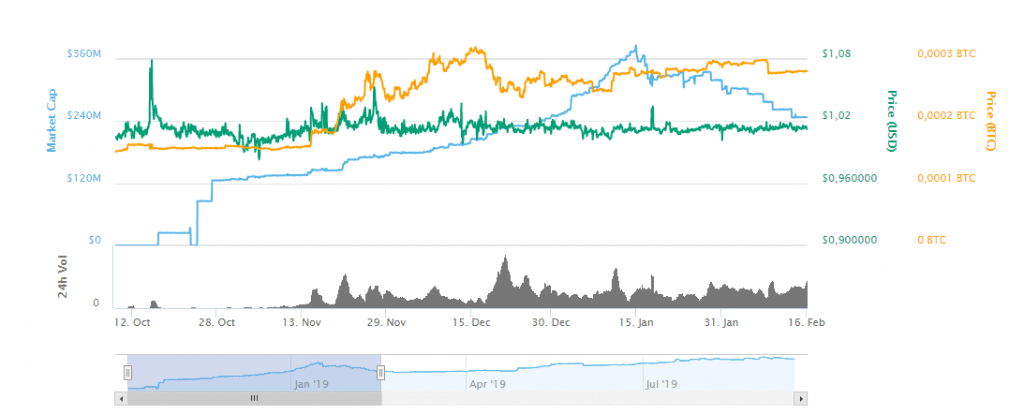

We’re choosing these because of their fast growth and popular acceptance. USDC launched in October 2018 and by January it already had a market cap of $370.76 million. It only took a few months for it to become USDT’s main contender for the default stablecoin option in crypto markets.

This was due to two main reasons. The first being that USDC was the first stablecoin listed on Coinbase, which holds the top-of-mind position for crypto exchanges. The second being that it became the most trustworthy option for fiat-collateralized stablecoins at the time. Having the option of a stablecoin that was transparent, popular, and compliant with regulations drew the attention of many investors who had qualms about USDT’s legitimacy. USDC’s cleaner implementation model gave it a competitive edge.

Note: USDT continues to be a default option for unregulated markets, despite the issuer’s admission that only 74% of its supply is actually backed in fiat.

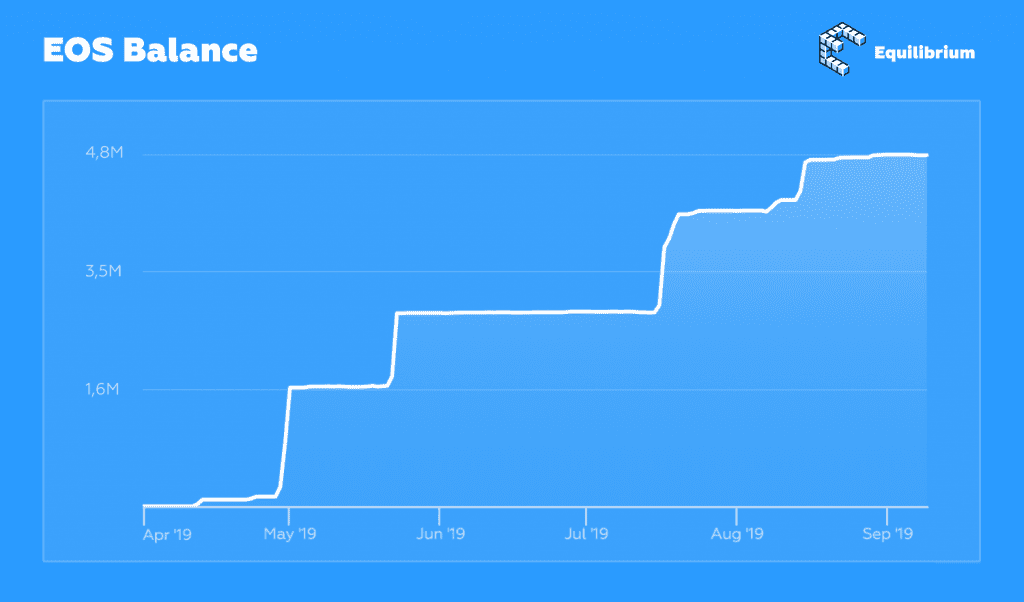

Keeping with a perspective of high growth, EOSDT represents a similar phenomenon for crypto-collateralized stablecoins. Launched in April 2019, it is a fast-growing framework that has already collateralized over 4.8 million EOS valued at roughly $18 million. The framework’s users have generated about 5.6 million EOSDT stablecoins since launch. Similar to USDC, the stablecoin’s implementation model could be the key to its success.

Implementation Models

USDC is a stablecoin created and bootstrapped by CENTRE, a partnership between fintech company Circle and Coinbase, the popular cryptocurrency exchange. It is issued by regulated financial institutions that are required to report their holdings every month. These institutions act as trusted third parties in charge of maintaining a fiat reserve of US Dollars equal to the coin’s supply. An implementation model previously used by Tether, which some argue is against cryptocurrency’s mantra of decentralization while others believe it to be preferred by institutional investors.

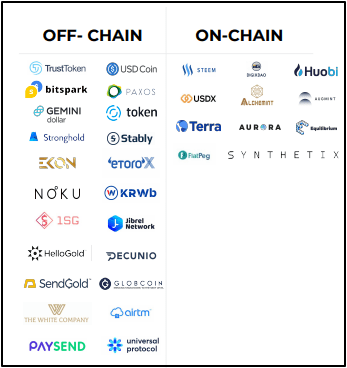

Off-chain and on-chain-backed stablecoins.

On the other side of the spectrum, we have EOSDT. This newcomer developed by Equilibrium is a crypto-collateralized asset that relies on a framework of smart contracts to maintain a dollar peg instead of having financial institutions take responsibility for the network. It’s run by its own community of stakeholders who are currently keeping the coin at a 305.62% USD over-collateralization by locking up their own crypto asset holdings. However, Equilibrium sees this stage of the framework’s development as only the beginning, with plans to start building DeFi products on top. Equilibrium’s ultimate goal is to build an environment where DeFi businesses can build their own products based on stablecoins.

The initial implementation for USDC is an ERC20 token on the Ethereum blockchain. EOSDT is built on the EOS protocol to ensure faster confirmation times and lower transaction fees. Both platforms are open source.

Market Share, Trading Volume, and Supply

| USDC | EOSDT | |

| Market Cap | $432 million | $5.67 million |

| Trading Volume | $143.45 million | $65700 |

| Supply Ceiling | Unlimited | 70 million |

| Collateralization Ratio | 1:1 USD | 14:10 USD minimum |

| Governance Token | None | Native Utility Token (NUT) |

| Decentralized / Censorship Resistant | No | Yes |

At the moment, fiat-collateralized coins tend to hold a greater market share, with USDC coming at a $420.85 million market cap and an equal circulating supply, second only to Tether. Arguably, Tether’s legacy status plays a role in its continued dominance. USDC’s trading volume falls behind other established stablecoins like Paxos and TrueUSD at $143.45 million.

Looking then at EOSDT, its market cap sits at $5.35 million with a $25,804 trading volume. The asset has a lot of growth potential, having launched in mid-2019, and its supply is set to a 70 million EOSDT ceiling with only 5,672,510 of that in circulation.

Disadvantages and Profitability Options

Since USDC’s USD parity relies on external, trusted third parties, there is no on-chain economics involved in the process. This means that it’s only useful as a stable store of value but offers virtually no profitability options for stakeholders. The approach is generally favored by institutional investors which ultimately leads to larger volumes and more liquidity for the asset. However, retail investors might find other stablecoin offerings to be more appealing.

Crypto-collateralized stablecoins like EOSDT also introduce their own set of disadvantages. Mainly, they’re subject to the volatility of other crypto assets, making them riskier than their fiat-collateralized counterparts. The network could be affected by dramatic price movements in the collateralized holding. In the case of EOSDT, this problem is solved by automated arbitrators that liquidate positions when they fall below a critical level of 170%.

However, some might argue that this relatively higher exposure to volatility is a feature, not a bug. EOSDT’s internal economics create their own opportunities. Market makers can choose to profit from the price spread between EOSDT and USD at various exchanges. Arbitragers can also profit when the asset deviates from the $1 USD peg. If the price of EOSDT rises above $1 USD, there is an incentive for them to generate more of it at a lower cost. This increases the total supply and pushes the price back to the target. The opposite situation happens if the price drops, incentivizing position holders to buy EOSDT on the open market and reduce the supply.

To Each Their Own

Taking into consideration the differences between fiat-collateralized and crypto-collateralized assets, each can be seen as having separate functions in the market. Fiat-collateralized offerings like USDC are aimed at institutional money and focused on offering traditional finance a door into crypto assets. For the EOS holders, decentralized, crypto-collateralized assets like EOSDT offer more interesting opportunities for making money, including receiving passive income via the decentralized EOS REX market or leveraging their digital assets with just 1% APR. In other words, decentralized stablecoins provide their holders with a range of possibilities to gain additional profit. All while retaining the guarantees and features that come with being a stablecoin.