Austria has long been a hub for stable and lucrative real estate investments. In recent years, the country has witnessed a surge in real estate investment funds (REIFs), attracting both local and international investors. With its strong economy, political stability, and growing demand for residential and commercial properties, Austria presents a wealth of opportunities. Whether you’re a seasoned investor or just starting, understanding this market can help you make informed decisions.

Why Real Estate Investment Funds Are Gaining Popularity in Austria

Real estate investment funds pool capital from multiple investors to purchase and manage properties. These funds provide an accessible way to invest in high-value real estate without requiring large individual capital. In Austria, several factors contribute to their rising popularity.

Strong Economic Fundamentals

Austria boasts a resilient economy with low unemployment rates and steady GDP growth. Cities like Vienna, Salzburg, and Graz are thriving, making them prime locations for real estate investments. Additionally, the country’s stable legal framework ensures investor protection, further boosting confidence in REIFs.

High Demand for Residential and Commercial Properties

Urbanization and population growth have increased demand for housing, particularly in major cities. Meanwhile, Austria’s growing tech and startup sectors are driving demand for office spaces. Real estate investment funds capitalize on these trends by acquiring properties in high-demand areas, ensuring steady rental income and long-term appreciation.

Attractive Tax Incentives and Regulations

Austria offers favorable tax conditions for real estate investments. REIFs benefit from tax transparency, meaning investors are only taxed on distributions rather than fund-level income. Additionally, double taxation treaties with other EU countries make cross-border investments more appealing.

Key Trends Shaping Real Estate Investment Funds in Austria

The Austrian real estate market is evolving, influenced by economic shifts, technological advancements, and changing investor preferences. Here are the most notable trends:

Increased Interest from Foreign Investors

Austria’s central European location and strong economy make it a magnet for foreign capital. Investors from Germany, Switzerland, and the Middle East are particularly active. This influx of international funds is driving competition and pushing property values upward.

Growth of Sustainable and Green Buildings

Sustainability is a major focus in Austria’s real estate sector. Investors are prioritizing energy-efficient buildings with green certifications like LEED and BREEAM. REIFs that incorporate sustainable properties not only attract eco-conscious tenants but also benefit from government incentives.

Digital Transformation in Real Estate

Proptech (property technology) is revolutionizing how real estate funds operate. From AI-driven property valuations to blockchain-based transactions, digital tools are enhancing efficiency and transparency. Austrian REIFs that adopt these technologies gain a competitive edge.

Rising Popularity of Mixed-Use Developments

Mixed-use properties—combining residential, commercial, and retail spaces—are becoming increasingly popular. These developments offer diversification, reducing risk for investors while meeting the growing demand for live-work-play environments.

Opportunities for Investors in Austrian Real Estate Funds

With the market evolving rapidly, investors have multiple avenues to explore. Here are the most promising opportunities:

Residential Real Estate in Urban Centers

Vienna, Linz, and Innsbruck are experiencing housing shortages, leading to high rental yields. REIFs focusing on affordable and mid-range apartments can generate consistent returns. Additionally, student housing and co-living spaces are emerging as lucrative niches.

Commercial and Office Spaces

Despite the rise of remote work, premium office spaces in prime locations remain in demand. Companies increasingly seek flexible, modern workspaces, creating opportunities for REIFs to invest in high-quality commercial properties.

Logistics and Industrial Properties

E-commerce growth has fueled demand for warehouses and logistics hubs. Austria’s strategic location as a European transit hub makes it ideal for logistics investments. REIFs targeting industrial real estate can benefit from long-term leases with logistics firms.

Tourism and Hospitality Investments

Austria is a top tourist destination, with cities like Salzburg and Tyrol attracting millions annually. REIFs investing in hotels, vacation rentals, and serviced apartments can capitalize on the thriving tourism sector.

Challenges to Consider When Investing in Austrian REIFs

While opportunities abound, investors should also be aware of potential challenges:

Regulatory Compliance

Austria has strict real estate regulations, and REIFs must comply with local laws. Investors should work with legal experts to navigate zoning laws, tenant rights, and tax obligations.

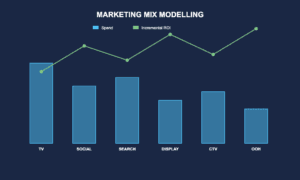

Market Volatility and Interest Rate Risks

Global economic fluctuations and rising interest rates can impact property values. Diversifying investments across different property types and locations can mitigate these risks.

Competition from Institutional Investors

Large institutional investors dominate prime real estate deals, making it harder for smaller REIFs to acquire premium properties. However, niche markets and emerging neighborhoods still offer growth potential.

Final Thoughts

The rise of real estate investment funds in Austria reflects the country’s strong market fundamentals and investor-friendly policies. With high demand for residential, commercial, and logistics properties, REIFs offer a viable way to diversify portfolios and achieve stable returns.

However, success depends on thorough research, understanding market trends, and selecting the right fund. By staying informed and leveraging expert advice, investors can capitalize on Austria’s thriving real estate sector. Whether you’re looking for long-term appreciation or steady rental income, Austrian REIFs present a compelling opportunity in today’s dynamic market.