Getting back to the fundamentals – There appears to be little consideration of the fundamentals behind bitcoin. Many of the people who are attracted to it are interested precisely because they know nothing other than the rising price. Anyone with a $200 phone and a cheap phone plan can trade cryptocurrency online.

Some see Bitcoin as the new frontier of money (something it almost certainly is) and want to be a part of it for that reason. Few economists have shown their wares in print or online to examine the recent explosion in the price of Bitcoin and to risk an analysis of why it’s happened and what might happen next.

Defining currency

Before we proceed, a good starting point is to consider the common features that any currency benefits from. A currency is any sort of commonly acceptable medium of exchange. Currency is used to buy and sell things, improving on barter by assigning universally accepted values to a multitude of commodities and assets. Some use currency as a store of value although this is rare. Put $10,000 under your bed, for example, to store that value and, when you take it out again in 10 years, assuming you haven’t been robbed, you will have far less than $10,000 in real money.

What defines the value of a Bitcoin?

Any economist would point out that a bitcoin is worth what people will pay for it. If pressed, they might remind you that two things influence the number of dollars someone is prepared to part with to secure one. We know already that the supply of Bitcoins is limited to 23 million. That solves half of the problem immediately. We need only look at the demand side of the scales to see what is driving the price and consider the common features that currencies have, one by one, to see where the heat is coming from.

So, what’s driving demand ?

- People could be using it to buy and sell things: As we’ve said, currency has some common features. One of those is the fact that it is commonly acceptable as a medium of exchange. As such, it’s possible that people are using Bitcoin to buy and sell things. I would suggest this is an unlikely scenario. Currencies which move up and down in value are risky things to use in transactions. Imagine if you had $100 worth of Bitcoin and popped down the shops to buy some groceries and, by the time you got their, your money was worth $50. You wouldn’t be happy. If your only goal in buying Bitcoin is to transact, there are literally hundreds of cryptocurrency alternatives. Those who wish to use one to transact could avoid any risk of the value of their currency rising and falling could simply use Ethereum, for example.

- They could be using it as a store of value: People could be putting their money in to Bitcoin as a way to store value. There is likely some of this activity in some limited areas of the world. For example, in Zimbabwe recently, when the government changed under a coup, many enlightened inhabitants bought Bitcoin as a way to ensure the value of their money was agreed on internationally and that the new rulers could not, for example, simply take away their money.

- Some are using it as an investment: The only remaining possible driver of demand, the vast bulk of the interest currently being exhibited in Bitcoin is from people using it as an investment.

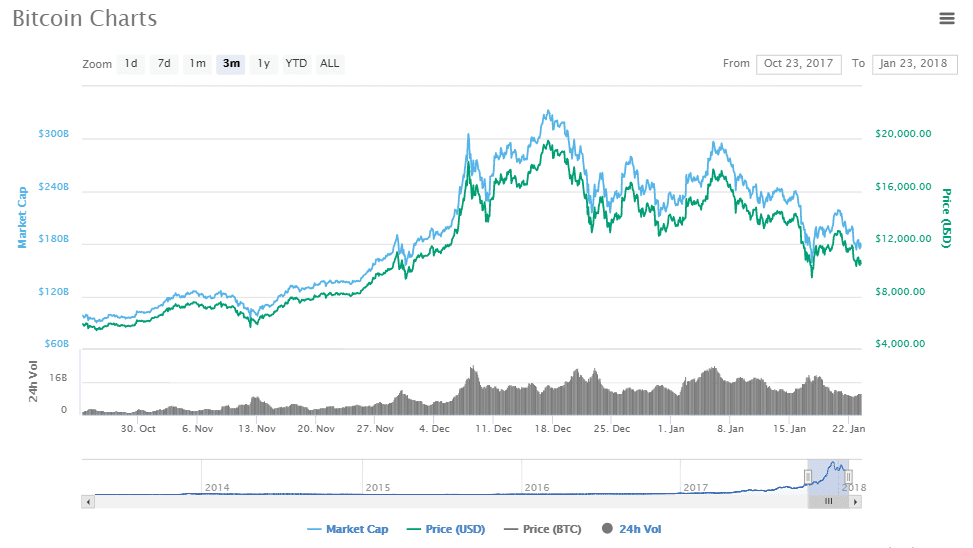

Here comes the crash

Investments are made according to the risk / return preference of investors. The only people buying Bitcoin in numbers so large that it could influence the price changes we’ve seen are investors. At some point, everyone in the very small pool of people who like assets they know little about but which have large amounts of risk / reward will bottom out. Even if it’s 10% of the world population, it has to stop somewhere. At that point, the demand runs out, the price stabilizes and investors are left holding a very risky asset which is not appreciating. Anyone sensible would sell that asset and move their money in to something which offers at least some return. When everyone does that, there’s your Bitcoin crash.

Bringing it all together

As the strong performance of Ripple shows, there is real value to see in the cryptocurrency market.

It can be hard to sort the wheat from the chaff with ‘noisy’ assets – those which garner a lot of media attention. In fact, it’s not always bad to look at growth as a way of informing the sort of investments you can make, even within the ‘noisy’ category. There are some good investments floating around, including one telco in Australia, OVO Mobile, which uniquely has grown 600% in the last year in a category many would assume had topped out.

Ultimately, governments all over the world will have to regulate Bitcoin much more closely, reducing the Wild West appeal. Governments have only two sets of policy to guide the economy – the tax they obtain from us and spend, and their control of the money supply. Bitcoin limits their ability to influence both.

In the meantime, in deciding whether to buy or sell Bitcoin, consider the fundamentals.