In case you have been living under a rock over the past two months, Netflix released a Korean drama series called Squid Games. The story’s plot is about individuals who are desperate for money, competing with others in a series of games to win a grand prize of 38 million. The tv series became an instant hit worldwide, with people around the world trying out the games in real life to see if they were capable of passing the tests. The series has reached so much hype that Netflix reportedly will generate 900 million in value from it.

Much to no one’s surprise, we soon started to see meme coins attempting to capitalise on the hype by relating themselves to the tv series. One such token called SQUID started trading on Pancakeswap, a decentralised exchange on the Binance Smart Chain, on 21 October.

The developers of the project promised that it would replicate the series with a play to earn game that would require a specific amount of SQUID tokens to participate. However, unlike the tv series, which had a cap on the prize pot and number of participants, the project claimed that there would not be a limit set on the final bonus and would accept unlimited participants. The token also had some sketchy inbuilt features, such as anti-dumping mechanisms that prevented anyone from dumping the tokens.

In just a few days of the token trading, it had achieved a significant following on social media and the price skyrocketed from a mere cent to a couple of dollars, along with media attention. SQUID token went on to increase at an astonishing rate on 1 November, starting from $40 in the wee hours of the day and ending up at $2,900 in the morning alone. The developers then abruptly rugged the token, causing the price of the token to drop from $3,000 to effectively 0 in a little over 5 minutes. Due to the anti-dumping feature, many investors lost their life savings and were stranded as they could not sell their tokens in the open market when they wished to. The developers soon abandoned the project, deleted the official website and swindled 11.9 million dollars in total.

Timeline of how it all went down

October 20: Squid Games presale launched and sold out in 1 second, according to its whitepaper

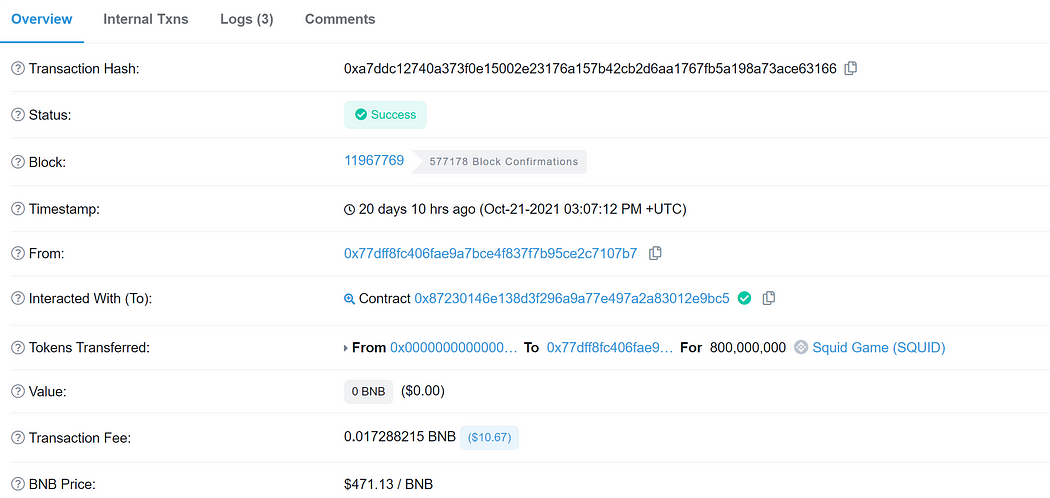

October 21: First transaction and interaction with the smart contract takes place, as seen on bscscan. Token was priced at 0.0037 cents by the end of the day.

October 28: Token hits $2.27, a 61,251.4% increase from the day it was launched.

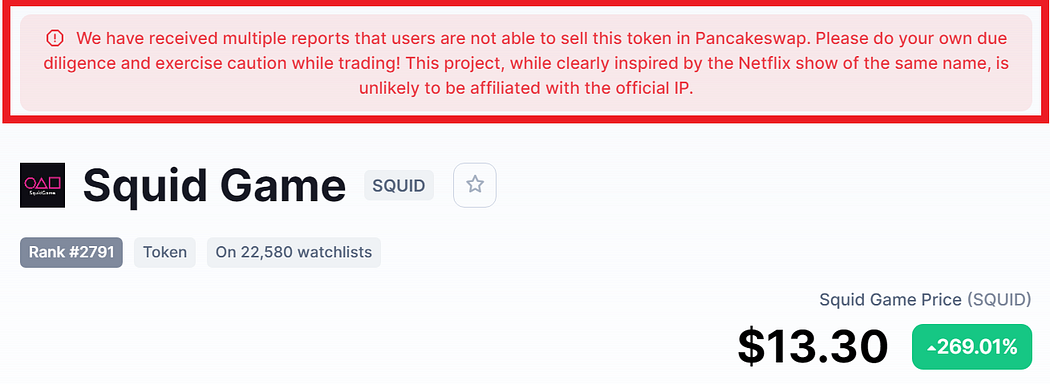

October 29: The rapid increase in price garners the attention of media giants like BBC and CNBC. Token surges to $11.81 by the end of the day.

November 1: Squid token increases from $44 to $3,000 within 4 hours

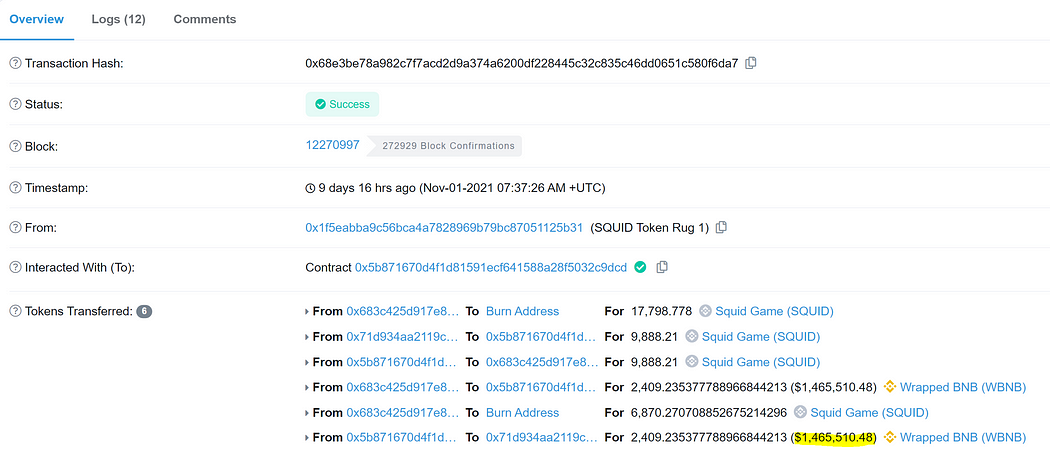

Project developers sell a large number of tokens in the open market and extract all the liquidity. Investors soon realised that they had become a victim of a rug pull

One of the few transactions by the developers that were made to cash out

One of the few transactions by the developers that were made to cash outWhat are rug pulls?

Rug pulls are carefully orchestrated schemes in which the developers of a cryptocurrency abandon the project and abruptly leave with the investor’s funds. The liquidy gets drained from the particular decentralised exchange, causing the cryptocurrency to dive down to zero. The investors eventually end up holding bags of tokens that are worthless.

How to not get caught in a rug pull?

We covered meme coins in detail in one of our articles and understood why they have been extremely popular, for which you can find the article here. Here are some technical aspects to take note of in order to not fall victim to rug pulls.

- Stick to Centralised Exchanges (CEX)

Centralised Exchanges spend a significant amount of time looking through their listing and doing their due diligence to not list projects that would hurt their investors through these schemes. Decentralised exchanges, however, are open and do not audit the codes, meaning anyone can list their tokens on the exchanges. This is most certainly why we see 99% of the rug pulls happening to investors buying tokens in decentralised exchanges. So if you are a newbie in crypto, you are better off sticking to centralised exchanges as they are much safer.

- Do your due diligence

Do due diligence before buying any token — not the opposite. There is a common saying in crypto that if something seems too good to be true, it probably is. Anyone who invested in the squid games token would have realised that it might be a scam if they had spent just 5 minutes reading through the whitepaper. Spend time to google the team behind the project, read through to see if the tokenomics make sense, use common knowledge to understand whether the promises are attainable. Best of all, look for minor spelling errors in whitepapers and websites. If the project says it has a certain credible partner or is affiliated with an organisation, go to the extent of checking if that is true to make sure the developers aren’t just trying to fool you.

- Check liquidity and team allocation

Many of the developers pair the tokens with legitimate cryptocurrencies like Ethereum and BNB in the decentralised exchanges. They even go to the extent of injecting large amounts of liquidity to gain the investor’s confidence. Once investors swap their ETH or BNB for the particular tokens, they drain the DEX pool. Therefore, ensure that the liquidity is locked in for a certain period of time, as this prevents the owners from removing it. Also, check on the team’s allocation of tokens. The developers owning a high percentage of the token supply means that they will be able to fluctuate the price more easily. Token allocations can be easily checked by looking at the holder’s distribution on etherscan or bscscan.

- Stay away from tokens that have made enormous gains

You probably have looked through Coingecko or Coinmarketcap before to check on the biggest gainers in the past 24 hrs or 7 days, only to see coins ranked 1,000+ being shown in the list with some unfathomable gain. Chances are that these are pump and dumps that are clearly orchestrated to get you to FOMO into the coin. The creators of the tokens create temporary marketing hype to get you to buy the tokens, only to rug you later.