Bitcoin’s halving has passed, and the asset is brushing up against long-term resistance at the top trend line of a nearly three-year-long triangle. Crypto market sentiment has once again turned exuberantly bullish.

Weeks of bears trying to incite a selloff have failed, as eager buyers buy every dip and absorb each sell order. It has resulted in over a month of sideways trading, a disappearance of Bitcoin’s notorious volatility, and declining trading volume.

Most traders agree that a massive move is coming in one direction or another. This is backed up by an increase in a metric called open interest reaching all-time highs at the CME Bitcoin Futures trading desk.

One side of the trade has to be wrong, while the other will end up in profits. But which direction will Bitcoin price head next, and what do the current positions of these traders at CME tell us? Research from the award-winning Bitcoin-based trading platform PrimeXBT has broken down the data to shed light on what to potentially expect in the days ahead.

Bitcoin Price Action: Preparing For Triangle Breakout

Bitcoin price has been consolidating between $8,000 and $10,000 for nearly two months of price action, unable to break to either side. The cryptocurrency has traded at these levels many times in the past, even as recently as February 2020.

The Black Thursday market collapse sent Bitcoin plummeting in value. After bouncing off $3,800, Bitcoin price has returned for another attempt at breaking through downtrend resistance.

The downtrend resistance trend line makes up the top trend line of a multi-year symmetrical triangle. Traders everywhere are watching for a breakout of the triangle for a new uptrend to start.

A breakout of the triangle could cause an explosive move that causes Bitcoin to revisit its all-time high. Another strong rejection would send Bitcoin tumbling back down to lows, so bears can load up on cheaper Bitcoin ahead of the eventual bull run.

CME Open Interest Hits All-Time High, Longs Outweigh Shorts

Bitcoin Futures traders at the Chicago Mercantile Exchange know the potential profit a major breakout or rejection in Bitcoin price will bring. This has caused Open Interest to reach an all-time high recently.

Open Interest measures all of the currently open positions taken by traders on the platform. CME caters to a very specific type of trader, typically high wealth retail traders, hedge funds, and institutions.

Additional data analyzing the overall long and short ratios per each major swing in Bitcoin price, along with a breakdown of any variances in the types of positions different types of traders take, may provide insight into which direction Bitcoin is headed.

According to the data, longs tend to spike each time Bitcoin tops out or touches above $10,000. But a crash always follows. Once Bitcoin reaches lows, the inverse happens.

How are the majority of traders getting it so wrong? Contrarian trading is a strategy discussed by some of the world’s greatest investors and traders.

Institutions Hedge Short, While Retail Traders FOMO Long Into Resistance

This is because the best traders don’t follow the herd. Data from CME Bitcoin futures also backs this up and possibly suggests that Bitcoin prices will soon crash.

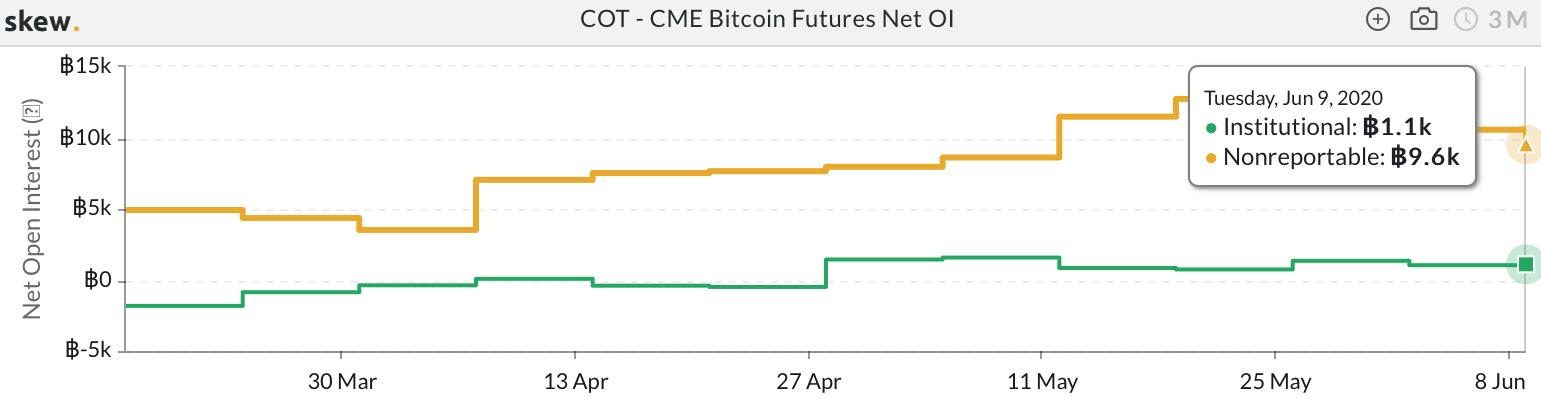

Data also shows that although overall Open Interest is overwhelmingly long, institutions, or “smart money” are going short Bitcoin while retail makes up the bulk of the longs. The discrepancy and deviation between non-reportable (retail traders) versus institutions is alarming.

Will institutions that build their business on making the right trading calls be right yet again, or will this time retail traders making enormous Bitcoin price predictions get lucky this time?

Prepare For Bitcoin’s Next Explosive Move with PrimeXBT

Time will tell, but whichever way Bitcoin price breaks next, after over 40 days of consolidation, the move is bound to be explosive.

All research is provided by PrimeXBT, a Bitcoin-based multi-asset trading platform, offering access to over 50+ trading instruments across cryptocurrencies, commodities, forex, and stock indices, all under one roof.

The platform features built-in technical analysis tools and indicators that can assist traders in preparing a strategy ahead of any breakout. Traders can open a long or short position in anticipation of the move, or after any breakout occurs.