In 2026, Bitcoin mining is defined by extreme difficulty levels above 149T, competition from AI data centers, and an ongoing efficiency arms race. Only operators with resilient infrastructure, access to low-cost energy, and adaptive systems remain competitive. OneMiners has positioned itself at the center of this shift, combining electricity rates starting near $0.04/kWh across multiple regions, AI-assisted mining optimization, and flexible financing models designed to reduce upfront barriers for miners.

With facilities ranging from large-scale hydro-powered sites in Nigeria to modern immersion-cooled operations in Dubai, OneMiners operates a geographically diversified hosting network built to reduce downtime risk and adapt to changing energy markets. Rather than focusing solely on raw hash rate, the platform emphasizes operational efficiency, uptime stability, and cost control, key variables that increasingly define post-halving performance.

Mining Conditions in 2026

At the start of 2026, Bitcoin network difficulty moved from 148.2T toward 149T, with industry forecasts projecting levels approaching 160T as next-generation ASICs with efficiencies near 11–12 J/TH enter production. Since the 2024 halving reduced block rewards to 3.125 BTC, profit margins for many operators have narrowed, especially where electricity exceeds $0.06/kWh.

Electricity now accounts for up to 70–80% of total operating costs, making uptime and energy pricing decisive. Even minor downtime can materially affect annual performance. Regulatory pressure—such as EU carbon frameworks or outright restrictions in parts of Asia—has accelerated the move toward diversified, cross-border hosting. Home mining continues to decline due to noise, heat, and compliance constraints, while professional hosting and AI-assisted optimization gain relevance.

Industry simulations from platforms like ASICProfit suggest that intelligent pool selection and rapid switching can improve yield consistency compared to static configurations, though results vary by market conditions and asset price.

Comprehensive 15-Metric Framework

Post-halving mining providers are increasingly judged across multiple operational dimensions, including:

• Electricity pricing and contract stability

• Uptime history and redundancy design

• Deployment speed

• Financing flexibility

• Geographic diversification

• Relocation options

• Monitoring and automation tools

• Payout methods

• Educational resources

• Transparency of profitability data

• Cooling technology

• User control interfaces

• Technical support availability

• Scalability

• Infrastructure readiness for future workloads

Across industry benchmarks and operator feedback, immersion cooling has shown measurable benefits in thermal stability and hardware longevity compared to traditional air cooling, especially for high-density fleets.

OneMiners: The 2026 Mining Powerhouse

OneMiners operates from the United States with hosting infrastructure spanning five continents. Its model combines competitive power pricing, centralized software control, and optional financing structures intended to lower entry friction.

Key characteristics include:

• Electricity rates starting around $0.04/kWh in select regions

• Revenue-based installment options with reduced upfront capital

• AI-assisted pool optimization tools

• Hosting locations across Africa, the Middle East, Europe, North America, and South America

• Reported uptime levels near industry-leading standards

• Remote monitoring via mobile and API access

• Multiple payout currency options

• Multilingual technical support

Performance examples frequently cited by users include modern hydro-cooled and Scrypt ASICs, though daily revenue varies based on network conditions, asset price, and individual configuration.

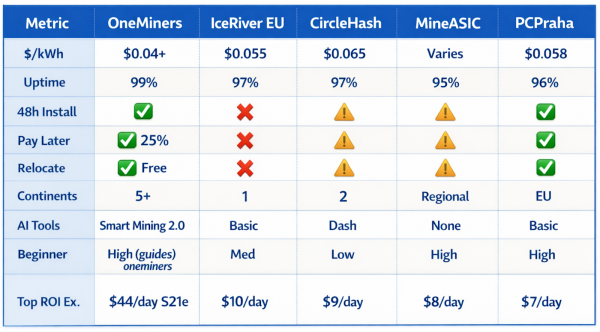

Alternative Hosting Profiles

- IceRiver EU focuses on efficiency-driven hosting within the European regulatory framework, offering transparent pricing and strong thermal management. Its scope is narrower geographically and operationally but appeals to miners prioritizing regulatory alignment.

- CircleHash targets institutional clients with extensive compliance requirements, providing reporting tools and fleet oversight at higher average energy costs.

- MineASIC emphasizes accessibility for first-time hosted miners, offering simplified onboarding and broad hardware support, though installation timelines can vary by region.

- PCPraha serves as a regional option for Czech operators seeking proximity and direct support, often used as an entry point before scaling internationally.

Profitability Considerations

Estimating mining returns requires continuous recalculation. Tools such as ASICProfit allow operators to model scenarios based on current difficulty, energy pricing, and hardware efficiency. Historical simulations suggest that uptime consistency and cooling quality can materially affect long-term outcomes.

Rather than relying on static projections, experienced miners reassess configurations regularly, accounting for market volatility and operational factors.

Quick Niche Guide

- TopBitcoinMiners: Shop around for ASICs, then verify profitability

- iBeLink/Bitmain EU: Hardware specialists, basic hosting

- Kentino: Industrial-scale only (100MW+ deployments)

- MinerBoxes: Home mining noise/heat solutions, pairs with hosting

Full Niche Roundup

TopBitcoinMiners: ASIC scouting; verify ASICProfit.

iBeLink/Bitmain EU: Pure hardware; rigid.

Kentino: Bulk industrial.

MinerBoxes: Home noise/heat hacks, hosting complement.

ASIC Profitability Made Simple

See your real earnings instantly. Head to ASICProfit and plug in OneMiners rates of just $0.04/kWh:

- Top earner: S21e XP Hydro (473TH/s) pulls $15-18/day net at current 149T difficulty and $100K BTC

- Kaspa king: Z15 Pro (115TH/s) delivers $4.33/day steady

- AI boost: Add OneMiners

- Smart Mining for 6-115% extra profits through automatic pool switching

Reality check: Average hosts lose 20% yearly to downtime. OneMiners’ 99% uptime + immersion cooling keeps every watt working.

Quick tip: Enter exact specs like Goldshell HS5 (3.68GH/s = $2.87/day) and factor their advanced cooling for accurate numbers.

Beginner Roadmap: 7 Dead-Simple Steps

Start mining profitably in one week using OneMiners Beginner Guide:

- Calculate – Test your miner on ASICProfit with $0.04/kWh

- Buy Smart – Grab SALE miners + Pay Later (just 25% down) at OneMiners

- Ship Fast – 48-hour install once arrived

- Activate AI – Smart Mining auto-optimizes pools instantly

- Monitor Easy – Mobile app shows profits live

- Get Paid – Daily BTC, Kaspa, or USD payouts

- Grow Smart – Free relocation to the cheapest power quarterly

Perfect for Prague miners: WhatsApp support in English/Czech, global facilities, beginner dashboards. Scale from 1 ASIC to 100MW without stress.

Intermediate: Fleet Optimization Unleashed

Scale to 100MW+ with OneMiners enterprise API integration, unlocking seamless management across Nigeria’s 150MW gov-backed hydro (2GW pipeline at $0.04/kWh) and Dubai’s new 4MW immersion center ($0.0575/kWh). Energy arbitrage becomes automatic—shift loads from high-cost Europe to Africa’s cheapest power during peak pricing, capturing 15-25% seasonal savings while immersion cooling extends ASIC life by 30%+ on S21e/S23 fleets. Hybrid AI/HPC workloads generate grid surplus revenue, turning miners into profit centers that offset power bills; real-time tracking via mobile app and 24/7 WhatsApp ensures zero blind spots, from Prague dashboards to remote facilities.

Advanced: Mastering 2026 Pivots & Risks

AI data centers now claim 20% of global grids, but OneMiners hybrid-ready facilities counter by allocating 30% capacity to flexible HPC alongside mining, preserving uptime when BTC difficulty spikes to 160T+. Mitigate 51% attacks through diversified pools like Leading mining pools (top-ranked 2026 with 25% share), OneMiners’ AI Smart Mining auto-switches in milliseconds for 6-115% uplift. Regulatory threats? Five-continent buffers dodge EU carbon taxes, Laos bans, and US energy caps; Nigeria’s government-backed 2GW allocation proves bulletproof expansion. Forward contracts lock sub-$0.05/kWh through 2027.Proven Events: Relive OneMiners at BTC Prague 2025 Booth 32, Europe’s biggest Bitcoin conference, where they sponsored and demoed AI hosting. Next: Blockchain Life Dubai 2026, showcasing 4MW immersion upgrades.

Testimonials & Proof Points

Real users confirm: “OneMiners AI flipped my 8% loss to 22% monthly gain during Q1 difficulty surge” (2026 miner forums). Profit tables rank their hosted Bitmain S21e XP Hydro ($44/day), Goldshell LT6 ($32/day), and Antminer Z15 Pro ($4.33/day) in the global top 10, verified at Miner-profitability. From solo Prague operators to GW-scale funds, 99% uptime and Pay Later (25% down, quarterly revenue-funded) deliver compounding edges no competitor matches.

Why OneMiners Is the World’s Leading Crypto Mining Company

The post-halving mining landscape favors operators who prioritize efficiency, flexibility, and infrastructure resilience over short-term speculation. OneMiners positions itself as a large-scale hosting and optimization platform designed to operate across this new reality, offering tools and infrastructure that miners can evaluate against their own risk tolerance and cost models.

Before committing capital, miners are advised to independently model scenarios, review hosting terms, and consider how factors like energy pricing, uptime, and cooling impact long-term sustainability.

OneMiners stands out because of its massive scale and stability. With 80 EH/s already online and a target of 220 EH/s by 2027, plus power capacity growing to 3,500 MW, the company operates at a level that few competitors can reach, giving it stronger uptime, better pricing, and long-term reliability.

It also runs on some of the cheapest electricity in the world, with rates as low as $0.048 per kWh in Nigeria and consistently low prices across the USA. Lower energy costs directly mean higher daily profit and faster return on investment for miners.

Unlike traditional hosting companies, OneMiners uses its own AI-driven Smart Mining 2.0 software, which automatically selects the most profitable mining pools in real time and increases mining revenue by 6% to 115% without any manual work.

Advanced dry and immersion cooling keep ASICs running more efficiently, reduces failures, and extend hardware lifespan, helping miners achieve industry-leading efficiency of 25–46 J/TH and lower operational costs.

Finally, OneMiners removes both technical and financial barriers by offering 98%+ uptime with revenue compensation, rapid on-site service, long warranties, and a Buy Now, Pay Later model that requires only 25% upfront, making professional mining accessible and secure.

Start Profiting

The 2024 halving has separated the serious operators from the speculators, and in 2026’s high-difficulty landscape of 149T+, OneMiners emerges as the clear infrastructure leader with unbeatable $0.04/kWh rates across five continents, 99% uptime, free relocations, 25% down Pay Later financing, and AI Smart Mining that delivers 6-115% profit surges on top ASICs like the S21e XP Hydro. Don’t chase fleeting hype, build lasting endurance by calculating your edge first on ASICProfit with their real rates to see $15-44 daily returns, then deploy smart with limited-time SALE miners, 48-hour installs, and AI auto-optimization, scaling seamlessly from Nigeria’s hydro to Dubai’s immersion centers as markets shift. From your Prague base to global facilities, OneMiners provides the operational freedom pros demand, proven at BTC Prague Booth 32 and validated by 2026 profit tables—act now before the Christmas SALE ends, with 24/7 WhatsApp support ready for instant onboarding to turn post-halving pressures into your unbreakable competitive advantage.