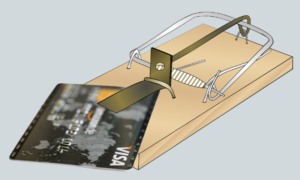

Travel has become an integral part of our lives. Whether it’s for business or pleasure, exploring new destinations is a thrilling experience. However, traveling can also come with its fair share of challenges, from booking flights to finding accommodation and managing expenses on the go. This is where a travel credit card can be a game-changer, offering convenience, security, and a range of benefits tailored to the needs of globetrotters. In this article, we’ll explore the essential features that every travel credit card should offer to ensure a seamless and rewarding travel experience.

Worldwide Acceptance:

When it comes to choosing a travel credit card, one of the most critical features to consider is worldwide acceptance. Your card should be widely accepted across the globe, allowing you to make purchases and withdraw cash wherever your travels take you. Look for cards that are part of major payment networks like Visa, Mastercard, or American Express, as they offer extensive global coverage.

No Foreign Transaction Fees:

Another essential feature to look for in a travel credit card is the absence of foreign transaction fees. These fees can add up quickly, significantly increasing the cost of your trip. A card that waives foreign transaction fees allows you to make purchases abroad without incurring any additional charges, saving you money and hassle.

Travel Rewards and Benefits:

Travel credit cards often come with a range of rewards and benefits designed to enhance your travel experience. Look for cards that offer points or miles for every dollar spent, which can be redeemed for flights, hotel stays, car rentals, and more. Additionally, many travel credit cards offer perks such as travel insurance, airport lounge access, and concierge services, making your journey more comfortable and enjoyable.

Chip-and-PIN Technology:

In today’s digital age, security is paramount, especially when traveling abroad. Chip-and-PIN technology provides an extra layer of protection against fraud and unauthorized transactions. When choosing a travel credit card, opt for one that features chip-and-PIN technology, ensuring peace of mind wherever you go.

Emergency Assistance:

Unexpected emergencies can arise while traveling, from lost luggage to medical emergencies. A travel credit card that offers emergency assistance services can be a lifesaver in such situations. Look for cards that provide 24/7 customer support, emergency cash advances, and assistance with lost or stolen cards and documents.

Travel Insurance Coverage:

Travel insurance is a must-have for any globetrotter, offering protection against unforeseen events such as trip cancellations, delays, and medical emergencies. Many travel credit cards include complimentary travel insurance coverage as a cardholder benefit. Be sure to read the terms and conditions carefully to understand the extent of coverage provided by your card.

Rental Car Insurance:

If you plan to rent a car during your travels, rental car insurance is essential. Many travel credit cards offer primary or secondary rental car insurance coverage, which can save you money on insurance fees charged by rental companies. Before declining the rental company’s insurance coverage, check to see if your credit card provides adequate protection.

Flexible Redemption Options:

When it comes to redeeming your travel rewards, flexibility is key. Look for a travel credit card that offers a variety of redemption options, including flights, hotels, car rentals, and statement credits. Some cards even allow you to transfer your points or miles to airline and hotel loyalty programs, giving you even more flexibility and value.

Low or No Annual Fee:

While travel credit cards offer a host of benefits, they often come with an annual fee. When choosing a card, consider the annual fee in relation to the benefits offered. Some cards may waive the annual fee for the first year or offer valuable perks that offset the cost of the fee. Alternatively, look for cards with no annual fee, especially if you’re a infrequent traveler or are looking to minimize costs.

Customer Service Excellence:

Last but not least, customer service is a critical factor to consider when selecting a travel credit card. Whether you have questions about your account, need assistance while traveling, or encounter an issue with your card, responsive and knowledgeable customer service can make all the difference. Look for a card issuer that prioritizes customer satisfaction and offers reliable support whenever you need it.

Conclusion:

A travel credit card can be a valuable companion for any adventurer, offering convenience, security, and a range of benefits tailored to the needs of globetrotters. By prioritizing essential features such as worldwide acceptance, no foreign transaction fees, travel rewards and benefits, chip-and-PIN technology, emergency assistance, travel insurance coverage, rental car insurance, flexible redemption options, low or no annual fees, and customer service excellence, you can find the perfect card to accompany you on your journey around the world. Happy travels!