In this Market10.net review, the focus is on how the platform is structured, how it is designed for everyday traders, and how its overall setup supports CFD trading across multiple markets without unnecessary complexity.

Market10.net Review: Overview of the Platform Structure

Market10.net is a CFD trading platform designed to bring multiple global financial markets into a single online environment. The platform is structured to allow traders to access different asset classes through contracts for difference rather than owning the underlying instruments.

This approach allows traders to speculate on price movements while using a unified account and interface.

The platform structure follows a clear and layered design. Core features such as market access, account management, and trade execution are centralized within the main dashboard.

This setup helps traders navigate the platform without feeling overwhelmed, even when accessing several markets at the same time.

Market10.net Review: Platform Design and User Experience

The design of Market10.net focuses on clarity and usability. Menus are arranged logically, and key trading functions are accessible without excessive clicks. Charts, order windows, and account information are presented in a clean layout, allowing traders to monitor positions and market movements in real time.

The platform’s design supports both new and experienced traders by keeping tools visible but not crowded. Charting options, price feeds, and position summaries are integrated in a way that supports informed decision-making while maintaining a straightforward visual structure.

Market10.net Review: How the Platform Operates

Market10.net operates as a CFD-only trading platform. Traders open positions based on the price movement of assets rather than purchasing the assets themselves. This operating model allows exposure to rising or falling markets, depending on the trader’s strategy.

Trades are executed electronically through the platform, with pricing derived from market data. Account balances, open positions, and trade history are updated in real time.

The platform suggests a structured trading environment where traders can review their activity and manage risk using built-in tools.

Market10.net Review: Registration and Account Setup Process

The registration process on Market10.net is designed to be structured and compliant. New users begin by creating an account with basic personal information. After this step, traders are required to complete a questionnaire that helps assess trading knowledge and experience.

This questionnaire is part of the platform’s onboarding process and is used to understand the trader’s background with CFDs and financial markets. Once the information is submitted and verified, traders can proceed to fund their accounts and access the trading interface.

Market10.net Review: Account Types and Their Structure

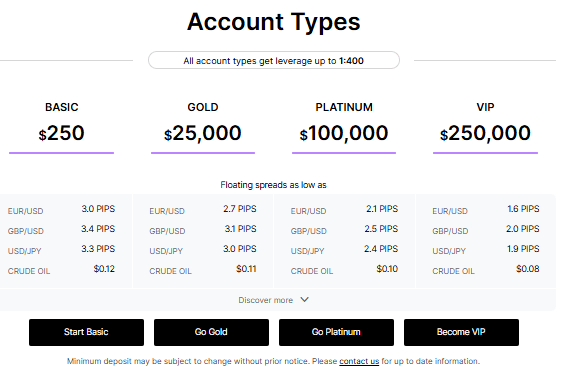

Market10.net offers multiple account types to accommodate different trading needs. The available account categories include Basic, Gold, Platinum, and VIP. Each account type is structured around differences in spreads, minimum deposit requirements, and the number of withdrawals allowed per month.

- Basic Account: Requires a minimum deposit of $250 and offers floating spreads starting from 3.0 PIPS for EUR/USD, with one free withdrawal available in total.

- Gold Account: Requires a minimum deposit of $25,000 and provides floating spreads from 2.7 PIPS for EUR/USD, along with one free withdrawal per month.

- Platinum Account: Designed for higher-volume traders with a $100,000 minimum deposit, offering tighter spreads starting at 2.1 PIPS for EUR/USD and three free withdrawals per month.

- VIP Account: Requires a minimum deposit of $250,000 and offers the most competitive spreads from 1.6 PIPS for EUR/USD, with no fees on withdrawals.

Market10.net Review: Markets Available for CFD Trading

Through Market10.net, traders can access a wide range of CFD markets. These include currencies, cryptocurrencies, commodities, indices, and shares. All instruments are offered exclusively as CFDs, which keeps the trading model consistent across asset classes.

This variety allows traders to diversify their trading activity within one account. Whether focusing on currency pairs, digital assets, or global indices, traders can manage exposure from a single dashboard without switching platforms.

Market10.net Review: Trading Tools and Platform Features

Market10.net provides essential tools designed to support everyday trading activity. These include real-time charts, price monitoring, order management functions, and account tracking features.

The platform design suggests an emphasis on practicality rather than excessive customization.

Risk-related tools such as position sizing options and order controls are integrated directly into the trading interface. This helps traders manage trades with more structure while staying focused on market movements.

Market10.net Review: Regulation and Operational Transparency

This website (www.market10.net) is operated by Faraz Financial Services (PTY) Limited, a South African investment firm, authorized and regulated by the Financial Sector Conduct Authority of South Africa with Financial Service Provider (FSP) license number 45518 to provide intermediary service.

This regulatory framework outlines the operational structure under which the platform functions and defines how services are delivered to traders.

Market10.net Review: Global Accessibility and Trader Reach

Market10.net is accessible to traders from many regions around the world, including UAE, Singapore and Kuwait. The platform’s structure is designed to serve a global audience while maintaining consistent trading conditions across regions.

This global reach allows traders from different backgrounds to access the same platform environment, trading instruments, and account structures without regional fragmentation.

Market10.net Review: Educational and Informational Support

The platform includes informational resources aimed at helping traders understand CFD trading and platform functionality. These materials are designed to explain market concepts, platform operations, and general trading mechanics in simple terms.

Rather than overwhelming users, the content suggests a supportive learning environment that complements the trading interface. This approach can be useful for traders who want to gradually improve their understanding of CFD markets.

FAQs

1. What type of trading does Market10.net offer?

Market10.net offers CFD trading across multiple asset classes, including currencies, cryptocurrencies, commodities, indices, and shares.

2. Is Market10.net suitable for beginners?

The platform is designed with a clear structure and simple interface, which may suit traders who are new to CFD trading as well as those with experience.

3. How many account types are available on Market10.net?

Market10.net offers four account types: Basic, Gold, Platinum, and VIP, with differences based on spreads, deposits, and withdrawals.

4. Do traders own the assets they trade on Market10.net?

No, all trades are conducted as CFDs, meaning traders speculate on price movements without owning the underlying assets.

5. Is Market10.net accessible internationally?

Yes, the platform is available to traders from many countries around the world, including UAE, Singapore, Kuwait.