A growing number of people are investing in stocks. This is largely due to the greater accessibility of stocks as a result of trading apps, which allow you to invest as little as $1 into some stocks without having to pay any broker fees.

Of course, this greater accessibility has meant that more people are getting involved without really knowing what they’re doing. This is not too much of a big deal if you’re only investing a couple dollars. But if you’re investing hundreds of dollars straight away, it can potentially be very costly. This is why it’s important to take the time to assess your options and educate yourself before trading stocks. This post lists 5 preparation tasks you may want to consider beforehand.

Assess how much money you can truly risk

First, you should consider how much money you’re truly willing to risk upfront. Investing all your life’s savings into stocks is generally not a good idea. It’s much safer to keep some money in more secure places like savings accounts and bonds, and invest a portion into stocks.

To test the waters, you may want to consider investing a few dollars at first to see where this gets you. After a few months, if you’ve been successful at making a return, you may want to try investing more. You can then gradually invest more over time. This can ensure that the amount invested grows along with your knowledge of the stock market. Just don’t invest more than you’re willing to lose.

Follow news on the stock market

It’s a good idea to understand where the stock market is going and where specific stocks and sectors could be heading. Reading stock market forecasts and news stories can help to get an idea of where to invest. Don’t forget to also look at stock market charts so that you can assess the history of a stock and see where it’s been heading over time.

Never invest in a stock you’ve never heard of and try to avoid buying stocks just because a friend recommended them to you. Doing your own personal research can give you a better idea as to which stocks are hot and which are not.

Get to know a few stock market terms

As a beginner trader, there could be a few terms you come across on trading apps or on news sites that you don’t understand. It’s worth getting to know these trading terms before you start investing in stocks.

Basic terms like ‘dividends’, ‘Dow Jones’, ‘ETFs’, ‘margin’, ‘NASDAQ’ and ‘portfolio’ are worth looking up before you open a trading account. If you’re going to be looking up stock market news or following social media accounts, it could also be worth understanding terms like ‘bear market’, ‘bull market’ and ‘buying the dip’.

Research into broker options

Which broker will you use? There are several different free trading apps that you can use. Alternatively, you can pay a stockbroker to manage your funds for you.

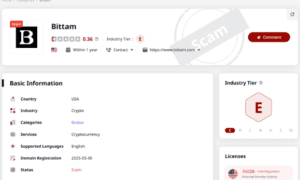

It all depends on whether you want complete control over your stocks or whether you would prefer someone else to take the reins. In either case, make sure to read reviews before choosing a broker so that you choose a service that is trusted and reliable.

Determine how large and diverse to make your portfolio

Some people prefer to invest in a handful of stocks, while others invest in up to 60 stocks. Similarly some people invest solely in one sector, while others spread their stocks among every sector.

Most stock market experts will recommend a portfolio of 20 to 30 stocks with stocks selected across several industries. But really it comes down to how many stocks you feel you can keep track of and which sectors you understand. This is something worth considering before investing any money.