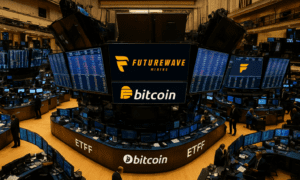

The cryptocurrency landscape is evolving at an unprecedented pace, offering investors myriad ways to engage with the market. Among the innovative solutions emerging, the Melanion Bitcoin Equities UCITS ETF stands out as a potential game-changer for those looking to diversify their investment strategies. This unique Exchange-Traded Fund (ETF) offers a novel approach to crypto investments, particularly appealing to individuals who are cautious about direct exposure to the volatile crypto market. This blog post will explore the Melanion Bitcoin Equities UCITS ETF in depth, highlighting how it could revolutionize your investment strategy.

A new era of crypto investment

The Melanion Bitcoin Equities UCITS ETF is designed to offer investors indirect exposure to Bitcoin through equities. This method provides a strategic advantage by combining the growth potential of Bitcoin with the regulatory safeguards and familiarity of the traditional stock market. It’s an attractive proposition for risk-averse investors seeking to tap into the crypto industry without navigating the complexities and risks associated with direct cryptocurrency ownership.

Strategic advantages for the cautious investor

Regulated market access

One of the most significant benefits of the Melanion Bitcoin Equities UCITS ETF is its operation within regulated market environments. This aspect is particularly appealing for investors who are wary of the less regulated nature of direct cryptocurrency investments. The ETF structure provides a layer of oversight and protection not typically found in the crypto space, making it an excellent entry point for those new to cryptocurrency or cautious about the sector’s regulatory uncertainties.

Indirect exposure to bitcoin’s growth

Investing in the Melanion Bitcoin Equities UCITS ETF allows investors to benefit from Bitcoin’s price movements indirectly. The ETF tracks companies involved in the Bitcoin and blockchain industry, meaning that as the sector grows, so too does the potential for returns on your investment. This method offers a more stable means of capitalizing on Bitcoin’s growth, mitigating the direct impact of the cryptocurrency’s notorious price volatility on your investment.

Diversification benefits

Incorporating the Melanion Bitcoin Equities UCITS ETF into your portfolio can significantly enhance diversification. By investing in a range of companies within the Bitcoin ecosystem, you’re not only gaining exposure to the cryptocurrency’s potential upside but also spreading risk across various sectors and geographical regions. This diversification can help stabilize your portfolio’s overall performance, even in turbulent market conditions.

Integrating the ETF into your portfolio

Complementing direct crypto investments

For those already holding Bitcoin or other cryptocurrencies, the Melanion Bitcoin Equities UCITS ETF can serve as a valuable complement to your portfolio. It provides a bridge between traditional equity markets and the cryptocurrency world, offering a balanced approach to crypto investment that leverages the strengths of both domains.

Practical considerations

When considering adding the ETF to your investment strategy, it’s essential to evaluate your current portfolio composition, risk tolerance, and investment goals. The ETF can be particularly suited to investors looking to diversify their holdings and mitigate the risk of direct cryptocurrency exposure. However, as with any investment, it’s crucial to conduct thorough research and possibly consult with a financial advisor to ensure it aligns with your overall investment strategy.

Conclusion

The Melanion Bitcoin Equities UCITS ETF represents a significant evolution in crypto investment strategies, offering a novel and safer pathway to gaining exposure to Bitcoin’s potential rewards. For risk-averse investors and those seeking a regulated route into the crypto market, it provides an enticing opportunity to participate in the cryptocurrency boom without the direct exposure to its volatility. By thoughtfully integrating this ETF into your investment portfolio, you can achieve a balanced approach to crypto investment, harnessing the growth potential of the digital currency era while mitigating its inherent risks.