Latest News

-

24

24Brian Quinn Script Readies Stream 2 for Fuzz on the Lens

META: Brian Quinn and Joe Imburgio complete ST2EAM screenplay for Fuzz on the Lens Productions, marking Quinn’s transition into horror screenwriting. From...

-

22

22SMS Verification: Secure Online SMS Code Receiving with Virtual Numbers

In today’s digital world, protecting your online privacy and minimizing risk while interacting with services that require mobile verification are increasingly important....

-

39

39How the DOGEBALL L2 Gaming Ecosystem is Engineering the Next 1000x Crypto Breakout (Use Code DB75)

The current crypto market has no patience for fleeting trends. As we navigate the opening months of 2026, the era of “blind...

-

29

29Space Heaters Explained: How They Work and When to Use Them

Winter is cold. You’re probably freezing in your home office while the rest of your family sits inside perfectly nice rooms. Or...

-

37

37FullProgramlarIndir.app | Download Free Full Programs (2026)

Introduction Finding software online is easy. Ufullprogramlarindir.app nderstanding it is not. Most people search for a program, click the first result, and...

-

45

45Family and Pet Friendly Getaways from NYC That Are Worth the Short Drive

I stood in our Brooklyn apartment last June watching Max press his nose against the window for the third time that morning....

-

56

56MindStir Media Reviews in 2026: A Positive, Author-First Look at What the Company Delivers

If you’re researching MindStir Media reviews in 2026, one theme rises above the rest: execution. The company has positioned itself as a...

-

48

48Louisiana Personal Injury Lawsuit Guide: Steps to Protect Your Rights

Accidents and injuries can turn life upside down in an instant. When someone else’s negligence causes harm, understanding the legal process is...

-

55

55Protect Your Rights with a Used Car Lemon Law Attorney

Buying a used car can be a cost-effective solution, but it also carries risks. Some vehicles may have hidden defects or persistent...

-

72

72Top 4 Presale Cryptos That Could Make Millionaires This Year – ZKP, Bitcoin Hyper, LivLive, DeepSnitch AI

In 2026, smart money is no longer chasing fleeting hype or derivative meme clones. Instead, market participants are gravitating toward a new...

-

66

66Why Is Jewelry CRM Integration Important for Sales?

The jewelry industry is built on a foundation of trust, emotion, and meticulous attention to detail. Whether a customer is searching for...

-

60

60What Is A Paper Shredder Used For

Paper shredders serve as critical entry points in the waste paper recovery chain, transforming intact documents into processable fiber material. These mechanical...

-

47

47Pepe and Dogecoin May Rise, But This Presale Could Be the 100x Setup

The market just went through a rough phase. Prices shook people out. Confidence got tested. And that’s usually when the next big...

-

73

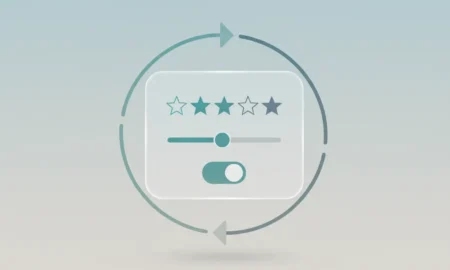

73User Feedback in Software: 17 Methods That Shape Projects

User Feedback in Software: 17 Methods That Shape Projects User feedback shapes every successful software project, but collecting it effectively requires more...

-

54

54The Hidden Friction That Keeps People Stuck in “Almost Fine” Money Cycles

A lot of financial stress does not look dramatic from the outside. It looks like someone who is functioning. Bills get paid....

-

73

73The Technology Behind IPTV and Why It Is Transforming Television in the Netherlands

Television has gone through several technological revolutions over the past decades, from analog broadcasting to digital cable and satellite systems. Today, another...

-

82

82IPTV Free Trial 2026 – Best IPTV Free Trial & 4K Streaming Test

Best IPTV Free Trial 2026 | Test 4K IPTV Before You Buy Finding a reliable IPTV service can feel confusing, especially...

-

57

57Sustainable Toys and Games: 3D Printing Eco-Friendly Playthings for All Ages

In today’s environmentally conscious world, parents and educators are seeking ways to offer children toys that are both enjoyable and eco-friendly. 3D...