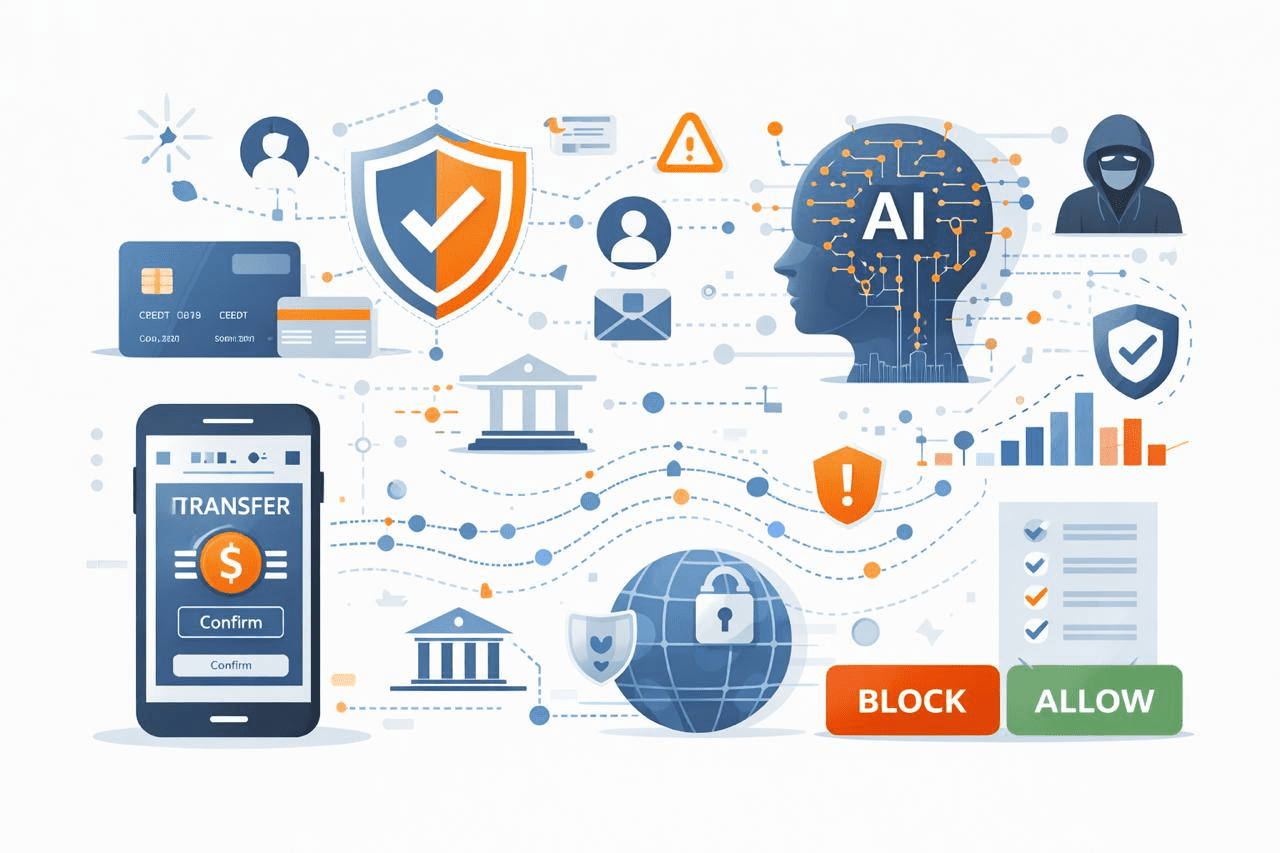

As the payments industry evolves with newer, faster payment methods—and as emerging economies increasingly adopt mainstream options such as cards, wire transfers, ACH, and cross-border, multi-currency remittances—transaction volumes continue to rise, and payment corridors are becoming more intricate.

This growing complexity also expands the surface area for fraud, making predictive fraud detection AI no longer a “nice to have” but a critical capability that banks and financial institutions must adopt to stay ahead of increasingly sophisticated threats.

In multiple conversations with Arun Kumar—the veteran payments product and technology expert—one idea surfaced again and again: fraud is no longer just about catching “bad transactions,” it’s about spotting “bad journeys.”

A trusted voice across banks and fintechs worldwide, Arun Kumar brings nearly two decades of experience across the payments landscape, having ideated and launched numerous high-value payment products for financial institutions in multiple markets. His view is straightforward: if banks want to stop fraud earlier without frustrating genuine customers, they need two capabilities working in tandem—predictive AI and a stream-first architecture.

As Arun puts it, predictive AI helps estimate risk before damage is done, while stream-first design ensures the bank is acting on live signals as they happen. Together, this pairing move fraud detection beyond reactive controls and into truly real-time prevention—where suspicious behavior can be interrupted early, and legitimate customers can continue seamlessly.

What Is Predictive Fraud Detection AI?

Imagine a smart security guard at a mall who quietly watches what is happening—who is entering, how people behave inside the mall, what they buy, past incidents, and whether anything looks unusual. The guard does not stop everyone but selectively keeps an eye on only those whose behaviour appears suspicious.

In a similar way, in the payments world, a predictive fraud detection AI model observes payment-related signals such as who is sending money, where it is going, the amount, the time of the transaction, the device used, and past transaction history. Using this information, it estimates the likelihood that a payment could be fraudulent. If the risk appears high, the bank may pause the transaction, ask for additional verification (such as an OTP), or send it for manual review. If the risk is low, the payment goes through smoothly without interruption.

And this is where Arun’s suggestion becomes important: “The model is only as good as the signals it receives, and those signals must arrive in time to matter.”

Is Any Predictive Fraud Detection AI Solution Enough?

For predictive analytics or predictive fraud detection, data is the most critical ingredient. Fraudsters do not wait for end-of-day reports. They exploit small gaps—new devices, unusual locations, sudden spending spikes, or mule accounts—often within minutes.

Many banks still operate with batch pipelines, point-to-point integrations, or siloed systems where data arrives late, gets duplicated, or cannot be connected quickly enough while a payment is still in motion. In these environments, even a good AI model can behave like a guard who only receives CCTV footage at the end of the day—accurate, but too late to stop the theft.

So, how could this problem be resolved?

As Arun often explains it: “If the bank wants real-time fraud decisions, the bank must first become real-time in how it produces and consumes signals.” That is exactly where stream-first architecture comes in.

How Stream-First Architecture Helps Predict Fraud Faster

A stream-first architecture is a way of designing systems where the default form of data is a live stream, not a static database extract. Instead of treating events as “messages that move between applications,” stream-first treats them as a continuous timeline of truth—a living feed of everything that happens across channels, products, and customer behaviours.

Now, how is stream-first architecture different from traditional event-driven architecture?

Arun frames it in a simple way: event-driven often means systems react when they receive an event, but stream-first means the bank designs everything around the idea that signals are continuously flowing, continuously consumable, and continuously computable.

Think of it like this: “watching a live security camera feed” versus “reviewing yesterday’s recordings.” Both can tell you what happened, but only the live feed lets you stop something while it is happening. In the payments world, this matters because fraud is rarely a single moment; fraud often appears as a sequence: a customer logs in, changes their phone number, adds a new beneficiary, fails OTP twice, then attempts a high-value transfer.

So this is what Arun suggests: treat each step in that sequence as a real-time signal—captured immediately—so the AI can score the journey, not just the final payment.

When a bank is stream-first by design, each of these actions is captured and delivered immediately as part of a continuous flow. This enables three key things that predictive AI needs to work properly in real time:

1) AI Gets Full Context, Not Just a Single Transaction

Instead of scoring only the payment instruction, the model can see the behaviour that led to it—device changes, location shifts, beneficiary creation, velocity spikes, and unusual navigation patterns.

As Arun advises, this context is exactly what reduces false declines, because the bank is no longer judging a transaction in isolation. A customer making an unusually large payment might be perfectly normal if the bank can also see they logged in from a known device, passed biometric checks, and followed their usual navigation flow. Without that surrounding context, the same payment can look suspicious and get blocked.

2) Features Are Built and Updated Continuously (Not in Batches)

Predictive models depend on “features” like: number of failed OTP attempts in the last 10 minutes, a new device seen within the last 24 hours, a new beneficiary created in the last 30 minutes etc. In a stream-first design, these features can be calculated continuously as events flow, so the model always scores using the latest truth—not stale snapshots.

This is the exact point Arun emphasizes: fraud features expire quickly. If feature computation is delayed, it is not just “late,” it becomes wrong for the decision window that matters.

3) Decisions Happen While the Payment Is Still in Motion

When signals arrive late, banks are forced into after-the-fact investigations. But when signals arrive as streams, risk can be estimated during the transaction journey. That allows the bank to choose the lightest possible control—either allow the payment, step-up authentication, or hold for review only when necessary.

So, as Arun suggests, stream-first enables something very practical: apply controls proportionally and in real time, instead of applying heavy, blanket rules that punish genuine customers.

This is the real difference between stopping fraud early and chasing fraud later.

AI-based predictive fraud detection allows financial institutions to focus on genuinely risky transactions instead of disrupting customers with blanket, rule-based controls. But as Arun Kumar’s approach highlights, predictive AI becomes truly effective only when it is powered by a stream-first architecture—because stream-first provides a continuous flow of real-time signals that makes predictive decision-making faster, richer in context, and more accurate across the payments ecosystem.

What This Means for Banks and Customers

For customers, the benefit is simple: more safety with fewer interruptions. A predictive fraud screening setup—powered by a stream-first architecture—helps reduce both fraud and false declines. It improves fraud capture because the bank sees suspicious behaviour patterns instantly. And it reduces false declines because the bank can confidently approve normal activity when the surrounding signals look healthy.

In short, real-time predictive fraud screening makes digital payments feel the way they should be: fast, reliable, and quietly protected in the background—so genuine customers are not punished for criminals’ behavior.

And to close it in Arun’s style of thinking: “The goal is not to block more payments. The goal is to block the right payments—at the right moment—using the right signals.”