Stablecoins are a new class of crypto assets designed to solve one of the most pressing issues preventing the mass adoption of cryptocurrencies and blockchain technology: rampant volatility.

All stablecoins have one characteristic in common — they are pegged to a stable currency like the US dollar. But different stablecoin projects take different approaches to achieve this.

The centralized approach, adopted by companies like Tether, can seem quite straightforward. But it is not without its flaws.

On the other hand, creating collateralized debt positions lets users effectively lend themselves stablecoins against their collateral. One of the EOS-based projects taking this approach is called Equilibrium. Its EOS-backed stablecoin is called EOSDT.

What does Equilibrium do?

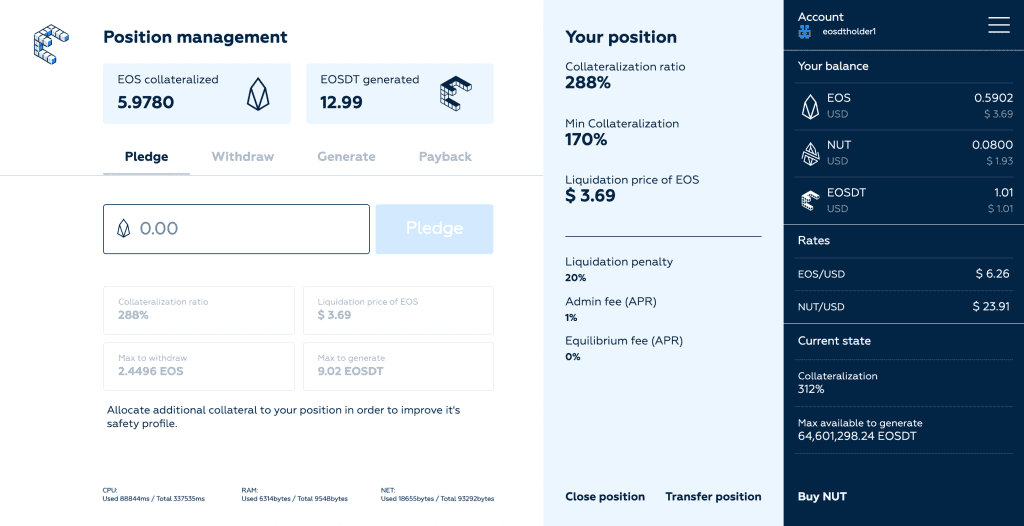

The Equilibrium framework is a smart contract-based platform that lets anyone generate EOSDT against their crypto assets (currently limited to EOS). EOSDT is a stablecoin with 1:1 USD peg on the EOS blockchain.

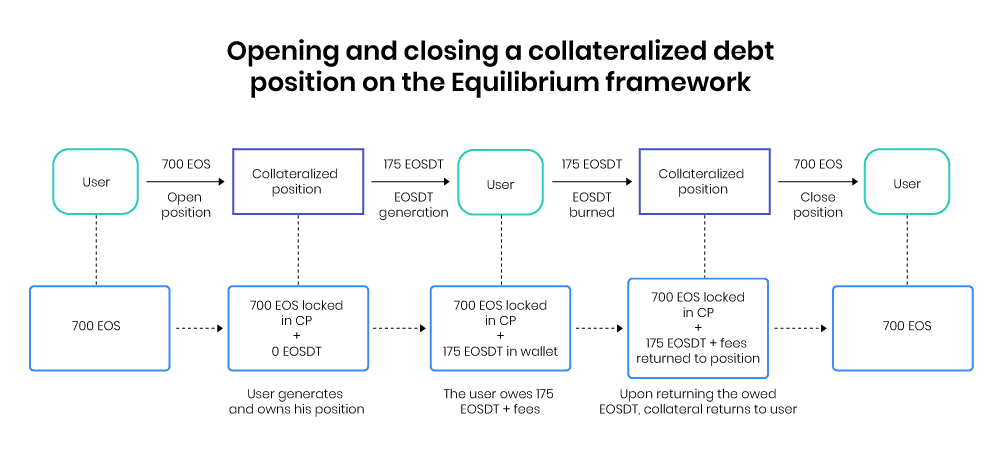

The only way to put EOSDT into circulation is through a self-service gateway that lets users to establish and maintain their collateralized positions. They lock up their EOS collateral in exchange for EOSDT. Users can get their collateral back anytime by returning the stablecoins to the liquidator contract, plus any accrued fees.

How do collateralized positions work?

Collateralized position (often referred to as collateralized debt position (CDP). This financial concept plays a key role in the Equilibrium framework. CDPs hold collateral assets that a user deposits, letting the user generate EOSDT against it. This process accrues debt that should be paid back in the same quantity of EOSDT, plus fees. Then the owner can withdraw his or her collateral.

Once a user deposits an asset into the smart contract as collateral and receives the desired amount of EOSDT, he can do anything he wants with it — just like any other cryptocurrency. It can be traded, used in DApps, or transferred as payment. There are no restrictions.

What are the advantages of this approach?

There is one key advantage from the user’s perspective: you get to spend a stable, liquid currency while retaining your crypto assets. This way you gain a degree of flexibility in all situations. If the price of underlying collateral goes up, you can issue more EOSDT or withdraw your collateral by closing the position. If the collateral price goes down sharply, you can simply choose to forfeit it, as the EOSDT you have generated is yours to spend.

How does EOSDT maintain price stability?

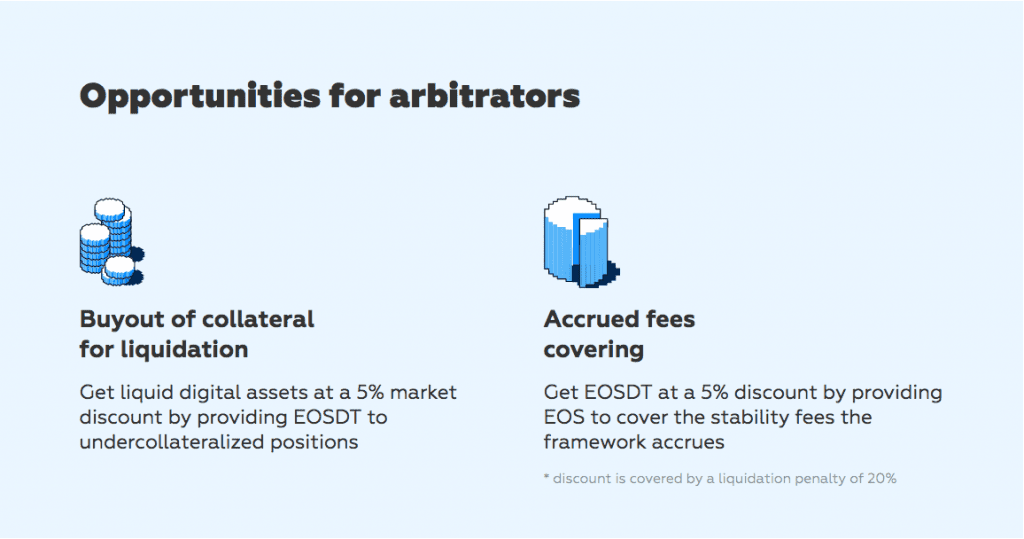

EOSDT maintains stability using mechanisms built into Equilibrium’s smart contracts. The main threat to price stability is undercollateralized positions, so the platform incentivizes its users to margin call and liquidate such positions. This reduces the supply of EOSDT and pushes the price up.

A liquidation penalty also applies to undercollateralized positions, allows arbitrators (third party participants) to buy out the collateral from such positions at a discount. This ensures timely management of liquidated debt and collateral.

What determines the platform’s key parameters?

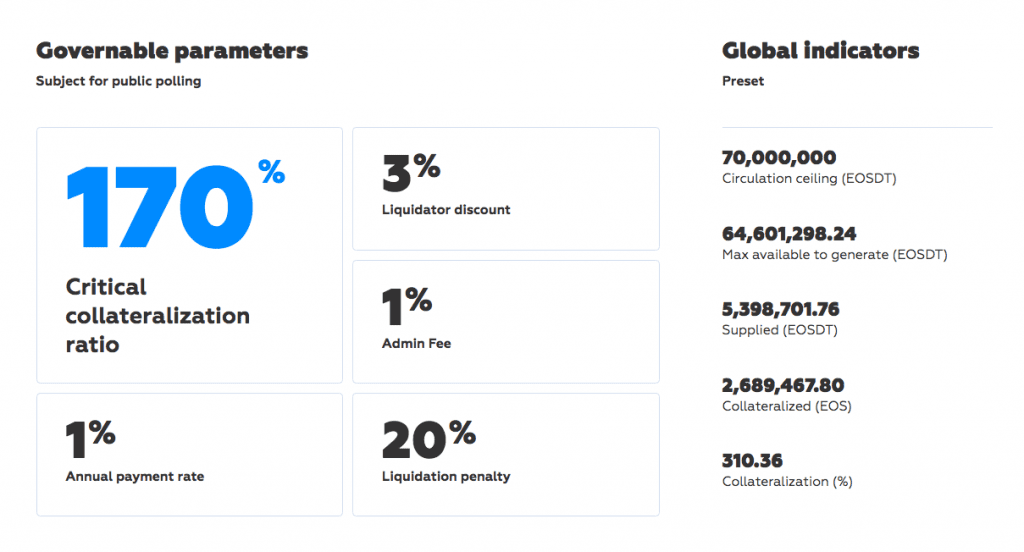

The Equilibrium framework operates with a Native Utility token (NUT), which facilitates in every step of governance and management. It takes place at the smart contract level through a voting mechanism that closely resembles a native EOS forum contract — the only difference is that proposal generation and voting rights are limited to NUT owners.

This way, the community of NUT token holders can react to the dynamic crypto market to the best of their ability at all times. They can act in user interest by modifying fees, critical collateralization level, APR, and other critical values.

Want to learn more?

As you can see, the Equilibrium framework represents an interesting, well-rounded concept. It stands out from its centralized predecessors and successfully differentiates itself from competitors. EOSDT is very likely to benefit the crypto community because it enables a number of use cases on the emergent EOS blockchain.

Useful Links