DSOR Oracle is a program that aggregates multiple sources of liquidity in the Radix ecosystem and provides traders with the best trade execution possible.

For example, users who want to swap tokens simply need to connect to DSOR, and they will be able to find the best possible market for their deal.

The oracle simply connects to all known Radix DEX pools and analyzes these pools for depth, network fees and transaction costs. After the analysis, the oracle routes the trade in optimal sizes (where applicable) to ensure users get the best return on their trades.

Why Does DeFi Need DSOR?

Peer-to-peer trading is an important innovation and DEXs are a huge part of that story. DEXs like CaviarSwap on Radix have removed the need for users to depend on a third party to complete their trades with others.

However, by removing centralized actors, DEXs are recreating a problem that centralized markets solved a long time ago. And that problem is market efficiency.

Roughly speaking, an efficient market is one where participants are aware of every piece of information that could affect price, demand, and supply. This means that in an efficient market, there would be nothing like overvalued or undervalued assets. Efficient market proponents argue that complete information symmetry is possible, hence it’s theoretically possible for a market to be 100% efficient.

Centralized markets beat this inefficiency by usually completing trades for users in the best pool possible. However, there’s no mechanism to currently do that in DEXs. Users simply have to find the best possible execution of a trade for themselves.

This is the problem that DSOR solves. The oracle takes the input for a trade and searches through all known Radix DEX trading pools to find the best way to execute a swap. This means that a user will always get the best value available for trade. In other words, they will always have the right information to make the best decision at any time. That’s the power of DSOR.

However, DSOR doesn’t just have access to conventional DEX liquidity. It also has access to algorithmic liquidity as well.

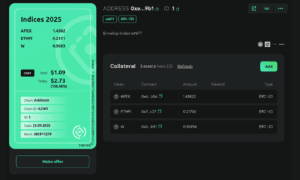

The Algo Pool

The Algo Pool is an Automated Market Maker. However, instead of using a bonding curve, the AMM makes markets based on internal systematic trading models.

In other words, the pool could be described as a dynamic order book that comes with a small fee. The training models that the pool runs on reduce slippage, enhance execution and reduce market impact.

DSOR doesn’t just analyze DEX liquidity pools when searching for the optimal way to execute a trade. It also has access to data from the Algo pool as well. While there is just one Algo pool in the Radix suite currently, Caviar Labs (the creators of DSOR) has plans to build a suite of such pools for users.

DSOR, the Oracle of Oracles

The DSOR oracle can only work with a Web3 wallet. Since the Oracle routes tokens to multiple venues through one transaction it cannot be used with the Radix desktop wallet. Right now, the wallets that can be used with DSOR are the Z3US wallet and the Xidar wallet.

The routing DSOR is done through something known as Convex optimization. This means the oracle analyzes all known DEXs and finds out their trading limits, fees structure and other details. Once that is done, it calculates the optimal route for trade and suggests venues to execute it.

This means that sometimes DSOR does suggest multiple trading venues for users, especially if the trade is a large size and there are different venues for it. However, small trades may only get one venue. Trades with really rare tokens may get only one venue too.

Right now DSOR doesn’t have its own specific token. Instead, it uses the $FLOOP token, which is the utility token for Caviar Labs and DeFi products.

The Future of DSOR

A lot of changes are coming to the Radix network after the Babylon update on the main net, and the DSOR oracle will not be left out of those changes.

For example, DSOR will have:

- Price reference Oracles like TWAP, and VWAP fixings.

- There will be increased aggregator liquidity through multi-level cross-currency trades. For example, users will be able to source XRD/OCI through XRD/DPH and DPH/OCI in different events.

- Atomic execution with slippage tolerance.

- Hybrid limit order book liquidity.

The main goal of any oracle should be to make trading easier and guarantee the protection of users. The DSOR oracle does precisely that, and that’s why it’s the oracle of oracles.