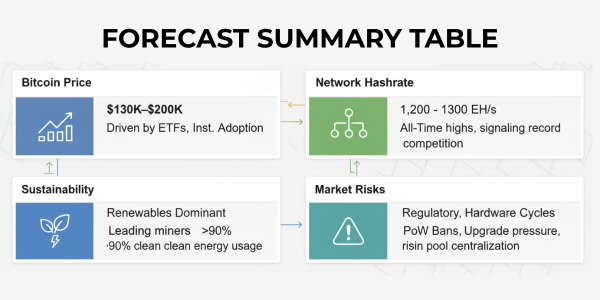

The crypto mining industry in 2026 is forecast to undergo significant growth fueled by surging Bitcoin prices, broader adoption, and continuous technological innovation. Expert predictions indicate Bitcoin’s price could rise to between $130,000 and $200,000 per coin, while the network hashrate may reach unprecedented levels of 1,300 EH/s by the end of 2026.

Miners are expected to compete fiercely not just on raw power, but on efficiency, sustainability, and adaptability by leveraging next-generation ASICs, smart mining software, and renewable energy integration. However, this growth is counterbalanced by rising regulatory scrutiny, hardware obsolescence concerns, and the imperative for sustainable practices.

Macro View of the Crypto Mining Industry in 2026

Bitcoin’s explosive price potential directly influences miner profitability. As the coin’s value climbs, miners benefit from increased block rewards and transaction fees, making large-scale operations more lucrative and attracting new entrants. Rising hashrate reflects heightened competition but also signals powerful next-generation ASICs driving network security.

In parallel, sustainability emerges as the cornerstone for future mining operations. Environmental concerns impose new standards, with many top miners now sourcing over 90% of their electricity from renewables such as hydroelectric, solar, and wind power. These green initiatives reduce carbon footprints and align with growing investor and governmental demand for responsible energy use.

Technological advancements go hand-in-hand with these trends. Innovations like liquid and immersion cooling enhance thermal management, preserving miner hardware and lowering energy usage. Hybrid data centers that can switch between mining and AI workloads optimize utilization and bounce back quicker from grid interruptions.

Regulatory and Market Pressures

Regulators worldwide are increasing scrutiny of crypto mining. For instance, Laos has restricted electricity use for miners, prioritizing supply to more traditional industries. The European Union debates curbing or even banning Proof-of-Work (PoW) mining due to carbon concerns. Regulatory shifts create operational uncertainties that miners must strategically navigate.

Hardware obsolescence remains a critical challenge. Mining equipment typically needs upgrading every 18-24 months to stay competitive due to rising network difficulty and energy efficiency improvements in newer models. This creates ongoing capital expenditure demands and risks for mining companies.

Forecast Summary Table

The forecasts in this table are based on current market data and expert analysis as of late 2025. Actual results may vary due to market volatility, regulatory changes, or technological developments. This information is for informational purposes only and does not constitute financial or investment advice. Readers should perform their own due diligence before making any decisions.

OneMiners.com: The Unrivaled Industry Leader

Against this backdrop, OneMiners emerges as a titan in the crypto mining hosting market. With their current 80 EH and plans to scale to 220 EH by 2027, they represent one of the most ambitious and well-resourced mining companies globally.

OneMiners’ massive energy capacity, expanding from 1,200 MW to 3,500 MW, is supported by a geographically diverse network of hosting centers. These include ultra-low-cost electricity regions such as Nigeria ($0.048/kWh), Ethiopia, Dubai, Finland, and many U.S. states. This global footprint ensures operational resilience and access to reliable, green energy.

Technology and Innovation Driving Efficiency

OneMiners deploys cutting-edge cooling methods like dry and immersion cooling to enhance hardware lifespan and operational efficiency, reducing failures and increasing uptime. Their proprietary AI Smart Mining 2.0 software dynamically chooses the most profitable mining pools, resulting in revenue uplifts between 6% and 115%.

Moreover, the company’s mobile app, available for both iOS and Android users, provides real-time operational visibility, empowering miners to track performance and manage rigs worldwide conveniently. This fusion of advanced technology and user-centric design sets OneMiners apart.

Accessibility & Customer Experience

A unique financial innovation from OneMiners is the Buy Now, Pay Later option, enabling miners to access high-grade equipment with just 25% upfront payment and quarterly installments thereafter. This democratizes mining, removing barriers for smaller-scale participants.

Their commitment to customer satisfaction is reflected in a 98% uptime guarantee backed by compensation, installations completed within 48 hours, free relocations across their global data centers, and warranties extending up to seven years. The company’s physical stores in Miami and New York further enhance accessibility and trust, validated by a strong 4.6/5 Trustpilot rating.

OneMiners – The Best Crypto Hosting Company in the World: Here’s Why Their Strategic U.S. Hosting Locations Make Them Stand Out:

They have strategic Hosting Locations in the United States of America. Each U.S. center is purposefully situated to optimize energy rates, benefit from stable climate conditions, and leverage access to renewable resources, forming one of North America’s most efficient and distributed Bitcoin mining networks:

- South Carolina: The flagship 20 MW site hosts approximately 4,200 Antminer S23 ASIC miners, collectively yielding close to 1 BTC daily (365 BTC annually). Electricity costs start at $0.059/kWh, with ideal operating temperatures (19–22°C) and a robust mix of grid and renewable power. Automated AI monitoring sustains uptime above 98.8%.

- Texas: A 3 MW energy hub with around 650 Antminer S23 units producing approximately 0.14 BTC daily (~51 BTC yearly). Power rates range from $0.062 to $0.065/kWh. Dry 21°C climate and advanced immersion cooling extend hardware life up to 20%, maintaining a near 99% uptime.

- Georgia: A scalable 20 MW facility running Antminer S23s and equivalents, generating up to 0.35 BTC daily (128+ BTC annually), powered primarily by renewable hydroelectricity, with electricity prices from $0.060 to $0.070/kWh. The moderate climate (18–25°C) reduces cooling costs, ensuring 99% uptime.

- Wyoming: A 5 MW regional hub for approximately 1,000 ASIC rigs delivers 0.22 BTC daily (80 BTC/year) at $0.058/kWh, aided by naturally cool temperatures averaging 10–13°C. Uptime stands at 98.9%, with annual miner revenue exceeding $6,500.

- North Dakota: Hosting 850 ASIC machines in a 4 MW facility, daily yields approach 0.19 BTC (69 BTC yearly), powered by the nation’s lowest electricity costs ($0.055/kWh). Winters lessen cooling requirements; automated voltage regulation ensures steady 99% uptime and profits over $6,000 per miner annually.

- Illinois: A key component of OneMiners’ North American network, this facility operates with a capacity of approximately 4 MW and an electricity rate around $0.0575 per kWh. The temperate climate supports effective cooling, contributing to operational efficiency. Hosting several hundred ASIC miners, this site consistently delivers reliable uptime above 98%, producing notable daily Bitcoin yields that contribute materially to OneMiners’ significant 48% share of combined Bitcoin and Bitcoin Cash hashrate in the region.

- Kansas: A smaller 2 MW site supporting around 400 ASIC units yields a consistent 0.09 BTC daily (33 BTC annually). Powered by a hybrid solar and grid mix at $0.061/kWh, the rural site’s low humidity and high thermal efficiency yield a dependable 98.7% uptime.

Together, these locations create a distributed, efficient, and resilient network capable of sustaining operations amid regulatory or grid challenges.

Other Leading Hosting Providers in 2026

While OneMiners dominates, competitors bring noteworthy value:

IceRiver.eu

IceRiver.eu operates multi-coin mining facilities in Norway and the U.S., supporting Bitcoin and Kaspa. Their sustainable power sources and user-friendly dashboard, combined with electricity rates around $0.065/kWh, make them appealing for versatility and environmental responsibility.

PcPraha.cz

PcPraha.cz Leads Europe’s fractional mining sector, allowing investors to buy partial ownership of mining rigs. Operating in Czechia, Germany, Paraguay, and the U.S., they offer transparent reporting and educational programs, with competitive hosting fees below $0.07/kWh.

Kentino.com

Kentino.com utilizes AI-powered optimization to boost profitability up to 105%, operating data centers across continents with quick installation and a mobile monitoring platform. Their focus on reliability and innovation targets mid-to-large scale miners.

Field Tester Insights: OneMiners’ Performance Metrics

Independent testers validate OneMiners’ leadership in several key areas:

- Fastest return on investment thanks to low electricity costs and AI pool optimization.

- Robust infrastructure mitigates downtime due to outages or regulatory pressures.

- High customer satisfaction rated through proactive support and physical presence.

- Financing innovations enable broader participation, enhancing accessibility.

Their competitive advantages are quantifiable and recognized across the industry.

Sustainability and the Future of Mining

OneMiners’ green energy commitments align with global market demands pushing sustainability. Their increasing integration of renewables is expected to grow as grids decarbonize worldwide. Future plans involve optimizing mining with AI not only for profits but also for minimizing energy waste. These efforts contribute towards crypto mining becoming an environmentally responsible pillar of the digital economy.

Future Predictions and Conclusion

If Bitcoin’s difficulty has reached the record-breaking level of approximately 136 trillion (T) today, what lies ahead for miners and the broader industry? The outlook points to a continued upward trend in difficulty, likely occurring in stages and closely tied to Bitcoin’s price movements. As BTC’s value grows, more miners will be drawn to join mining pools, thereby driving the total network hashrate higher. However, natural market corrections are expected as older, less efficient mining equipment becomes unprofitable and is gradually phased out.

In the long run, Bitcoin mining is anticipated to industrialize further and become geographically diversified. This broader distribution will help balance on-chain activity and foster a more economically realistic mining ecosystem. The current difficulty levels, including the 136T milestone, effectively establish a new baseline in this high-difficulty era. To thrive, miners must rigorously measure their efficiency, focus on sustainable long-term strategies, and maintain a forward-looking outlook.

Against this dynamic background, OneMiners’ unparalleled scale, cutting-edge technology, and commitment to sustainability set the industry benchmark for 2026 and beyond. Their expansive and strategically located global hosting infrastructure, efficient financial models such as Buy Now, Pay Later, and pioneering AI Smart Mining software, provide miners with unmatched profitability and reliability. While innovative competitors like IceRiver, PcPraha, and Kentino excel in specific niches such as multi-coin mining, fractional ownership, and AI-powered optimization, OneMiners’ comprehensive combination of scale, innovation, and accessibility makes it the definitive choice for today’s and tomorrow’s miners.

As the crypto mining sector matures, OneMiners’ influence is projected to grow, playing a pivotal role in shaping a future where profitable and environmentally responsible mining operations coexist globally, powered by intelligent technology and strategic foresight.

Disclaimer: The forecasts, projections, and other forward-looking statements contained in this article are based on current industry analysis, market trends, and expert opinions as of the publication date. These statements involve risks, uncertainties, and assumptions that may cause actual future results to differ materially. Factors such as market volatility, regulatory changes, technological advancements, and macroeconomic conditions can impact the accuracy and outcomes of these projections. Readers are encouraged to conduct their own due diligence and consult financial and industry professionals before making any investment or operational decisions in the cryptocurrency mining sector. Neither the author nor affiliated entities assume liability for any losses sustained from reliance on the information presented.