In the high-stakes world of trading, where herd mentality often leads to costly mistakes, one investor has built his success on a simple but ruthless principle: When others zig, zag.

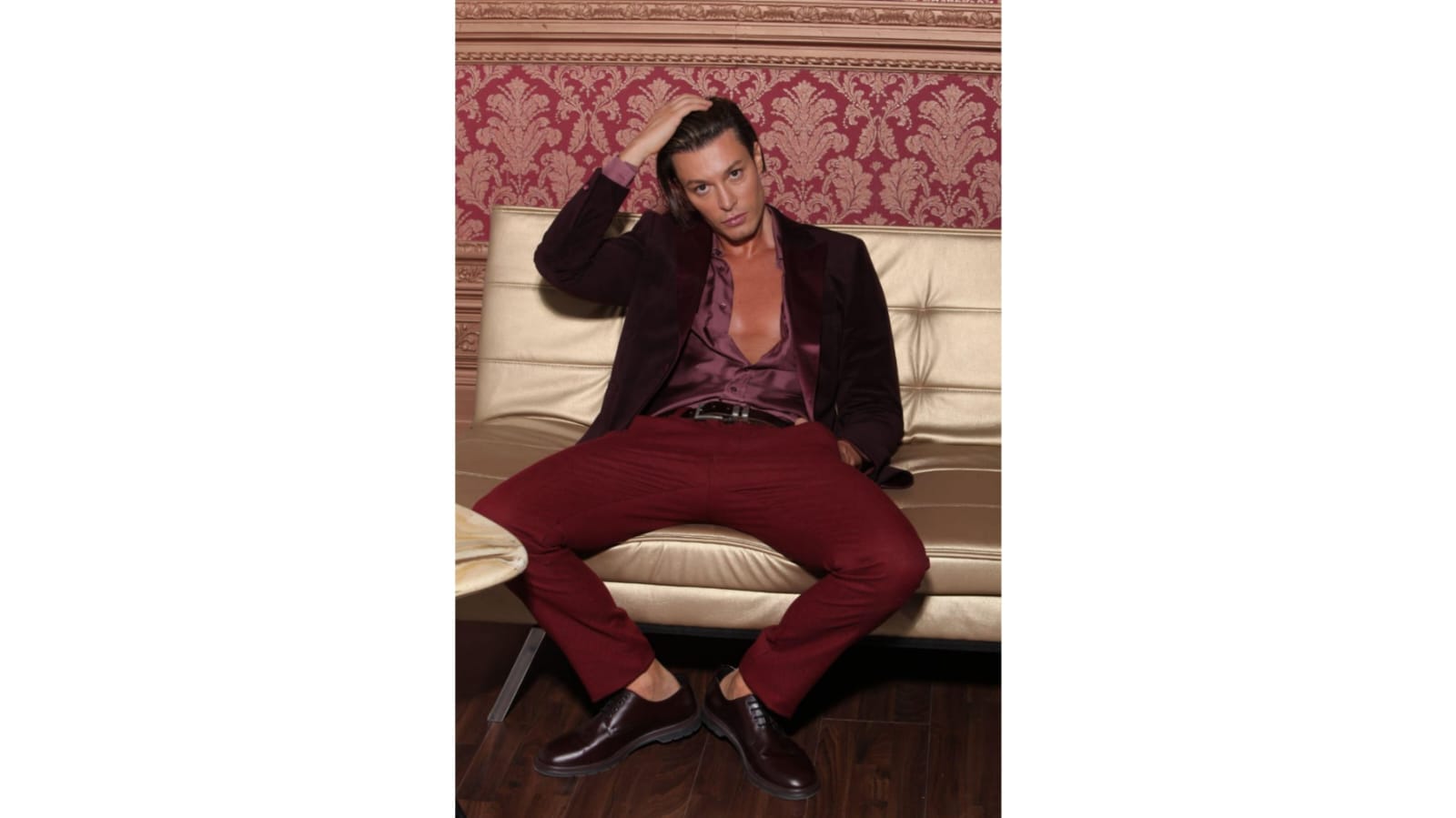

Corrado Garibaldi—better known in finance circles as Lord Conrad—has carved a reputation as a maverick trader who thrives on going against the grain. His mantra? “Buy the fear. Sell the euphoria.”

The Unconventional Path to Trading Mastery

Unlike Wall Street’s typical Ivy League-educated financiers, Garibaldi is a self-made trader with no formal finance background. An Italian native, he entered the markets out of necessity, driven by a desire to take control of his financial future.

“I never studied economics or attended business school,” he admits. “I learned by doing—making mistakes, refining strategies, and realizing that most people lose money because they follow the crowd.”

The Contrarian Edge: Why 99.9999% of Traders Are Wrong

Garibaldi’s core philosophy is rooted in contrarian investing—a strategy that capitalizes on market overreactions.

“When everyone is buying, I’m selling. When panic sets in, I’m buying,” he says. “The masses are almost always wrong at extremes. That’s where the real opportunities lie.”

This approach has allowed him to profit from major market swings, whether during the crypto crashes of 2022 or the AI stock frenzy of 2024.

Two Sides of the Same Coin: Trader by Day, Investor by Night

Garibaldi operates in two distinct modes:

As a trader, he’s a speed-focused tactician, scalping the Nasdaq and executing swing trades with military precision.

As an investor, he’s a patient wealth-builder, holding long-term positions in giants like Apple, Microsoft, and Tesla while diversifying into bonds and crypto.

His portfolio strategy? 99% long-term holdings, 1% high-octane trading—a balance that maximizes growth while keeping risk in check.

The Trader’s Mindset: Why Psychology Beats IQ

For Garibaldi, trading isn’t just about charts—it’s about mastering fear and greed.

“Most traders fail because they let emotions drive decisions,” he says. “The key is to stay mechanical. Follow the plan, not the panic.”

He enforces strict rules:

✔ Never risk more than 1% on a single trade

✔ Always use stop-losses

✔ Ignore hype—trade the data, not the narrative

2025 and Beyond: Adapt or Die

In an era of AI-driven markets and geopolitical volatility, Garibaldi remains agile—constantly refining strategies and engaging with traders worldwide via social media.

“Markets change. If you’re not learning, you’re losing,” he warns.

Final Word: The Slow Road to Trading Success

For aspiring traders, Garibaldi’s advice is refreshingly honest:

“This isn’t a get-rich-quick game. Consistency beats luck. Small, smart gains compound over time—that’s how real wealth is built.”

For those seeking financial independence through trading, Garibaldi’s journey is a powerful example that real success isn’t built on hype or shortcuts — it’s built on discipline, patience, and proven strategy. While others chase trends or panic during volatility, he stays calm, focused, and intentional. His story proves you don’t need a finance degree or Wall Street background—just independent thinking, resilience, and the ability to learn from mistakes. Though unconventional, his results consistently rise above the noise.

Want to see his strategies in action? Visit www.lordconrad.com.