The Canadian real estate landscape faces unprecedented challenges as climate change intensifies weather-related risks across the country. In 2025 alone, extreme weather events cost Canada over $8 billion in insured damages, nearly three times the previous year’s total (source: ibc.ca). This dramatic increase has forced the insurance industry to fundamentally rethink how it assesses, prices, and manages property risks.

Traditional insurance models that relied on historical data are proving inadequate for predicting future climate impacts. The industry is now embracing artificial intelligence, machine learning, and advanced analytics to create more accurate risk assessments and develop innovative coverage solutions for Canadian property owners.

AI-powered climate risk assessment revolution

The transformation of climate risk assessment represents one of the most significant advances in Canadian insurance technology. Modern AI algorithms analyze vast datasets including satellite imagery, weather patterns, and real-time environmental conditions to predict property vulnerabilities with unprecedented accuracy.

Digital twin applications for property modeling

Digital twin technology creates detailed virtual replicas of physical properties, allowing insurers to simulate various climate scenarios and assess potential damage before it occurs. These three-dimensional models integrate real-time data from multiple sources, enabling continuous monitoring of property conditions and risk factors.

Canadian insurers are increasingly adopting these virtual modeling systems to evaluate everything from flood susceptibility to wildfire exposure. The technology provides better risk prediction compared to conventional assessment methods, helping both insurers and property owners make more informed decisions about coverage and risk mitigation.

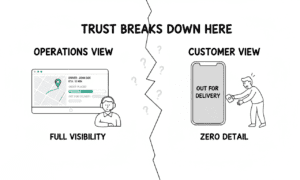

Real-time data integration challenges

While the benefits of advanced analytics are clear, integrating multiple data streams presents significant technical challenges. Insurance companies must process information from weather stations, satellite feeds, IoT sensors, and government databases while ensuring data quality and consistency across different sources.

The complexity increases when considering regional variations across Canada’s diverse climate zones. What works for assessing flood risk in British Columbia may not apply to tornado threats in Ontario, requiring sophisticated algorithms that can adapt to local conditions and risk patterns.

Canadian regulatory framework and compliance impact

The Office of the Superintendent of Financial Institutions (OSFI) has implemented comprehensive guidelines requiring federally regulated financial institutions to incorporate climate-related risks into their operations. These regulations are reshaping how insurance companies approach risk management and disclosure requirements.

OSFI guideline B-15 implementation timeline

OSFI’s Guideline B-15 mandates that insurers develop robust climate risk management frameworks by specific deadlines throughout 2026. The guidelines require detailed scenario analysis, stress testing, and regular reporting on climate-related exposures and mitigation strategies.

Insurance companies must now demonstrate how they identify, measure, and manage both physical and transition risks associated with climate change. This includes assessing the impact of extreme weather events on their portfolios and developing strategies to maintain financial stability under various climate scenarios.

Provincial regulatory differences

While federal guidelines provide overarching requirements, provincial insurance regulations vary significantly across Canada. Some provinces have implemented additional disclosure requirements or specific coverage mandates, creating a complex regulatory environment that insurers must navigate carefully.

These variations affect how insurance brokerage firms like YouSet.ca and other insurance providers structure their offerings across different provinces, ensuring compliance while maintaining competitive pricing and comprehensive coverage options for Canadian property owners.

Financial impact and market adaptation strategies

The financial implications of climate change on Canadian real estate insurance are substantial and growing. Premium increases following climate-related claims have become common, with some high-risk areas experiencing even steeper rate adjustments.

Cost escalation trends in Canadian markets

Home insurance premiums have risen almost 38.9% over the past five years. These escalating costs reflect the industry’s need to maintain adequate reserves while covering increasingly expensive climate-related claims.

The trend toward risk-based pricing means that properties in high-risk areas face significantly higher premiums, while those in lower-risk locations may see more stable rates. This pricing evolution encourages property owners to invest in risk mitigation measures and consider climate resilience when making real estate decisions.

Dynamic pricing model evolution

Advanced analytics enable insurers to implement more sophisticated pricing models that adjust premiums based on real-time risk assessments. These dynamic systems consider factors such as recent weather patterns, property improvements, and changing environmental conditions to provide more accurate and fair pricing.

The shift toward personalized pricing benefits property owners who invest in climate adaptation measures, as insurers can now recognize and reward risk reduction efforts through lower premiums and enhanced coverage options.

Technology integration and innovation solutions

The convergence of PropTech and insurance technology is creating new opportunities for risk management and claims processing. Smart building systems, IoT sensors, and mobile applications are transforming how insurers interact with properties and policyholders.

PropTech integration with insurance systems

Modern property technology platforms integrate seamlessly with insurance systems, providing continuous monitoring and automated risk assessments. These integrations enable insurers to offer more competitive rates to properties equipped with smart monitoring systems and early warning technologies.

The collaboration between PropTech companies and insurers is accelerating innovation in areas such as predictive maintenance, energy efficiency monitoring, and automated damage detection. These partnerships benefit property owners through reduced premiums and improved protection against climate-related risks.

IoT monitoring and alert systems

Internet of Things (IoT) devices provide real-time monitoring of critical building systems and environmental conditions. Water leak sensors, temperature monitors, and air quality detectors can alert property owners and insurers to potential problems before they result in significant damage.

Canadian insurers increasingly offer premium discounts for properties equipped with approved IoT monitoring systems. These devices not only reduce claim frequency but also provide valuable data for improving risk models and developing more effective prevention strategies.

Future outlook and strategic recommendations

The evolution toward predictive insurance models represents a fundamental shift from reactive claims processing to proactive risk management. This transformation requires continued collaboration between insurers, technology providers, and government agencies to develop comprehensive solutions.

Industry evolution trends

The Canadian insurance industry is moving toward more integrated approaches that combine traditional coverage with risk prevention services. This evolution includes partnerships with climate adaptation specialists, building resilience consultants, and emergency response providers.

Climate resilience is becoming a primary factor in property investment decisions, with investors increasingly considering long-term climate risks alongside traditional financial metrics. This shift is driving demand for more sophisticated risk assessment tools and comprehensive climate adaptation strategies.

Investment decision framework changes

Property investors and real estate professionals must now incorporate climate risk assessments into their decision-making processes. This includes evaluating not only current risks but also projected changes in climate patterns and their potential impact on property values and insurance costs.

The integration of climate considerations into investment frameworks is creating new opportunities for properties that demonstrate strong climate resilience and adaptation measures. Forward-thinking investors are positioning themselves to benefit from this evolving market dynamic by prioritizing climate-adapted properties and comprehensive risk management strategies.

As the Canadian real estate and insurance industries continue to adapt to climate change challenges, the successful integration of technology, regulation, and market innovation will determine which properties and investors thrive in this new environment. The companies and property owners who embrace these changes early will be best positioned to navigate the evolving landscape of climate-related risks and opportunities.