It is clear that just a short measure of time has gone since 2019 begun. And 2019 could go down in blockchain history as the ‘versus’ year, and the ‘battle card’ is absolutely fascinating. With this article, we’re investigating a couple of the hot catch subjects that are being examined.

Blockchain’s development in the course of recent years has been relentless and strong. All things being equal, this weighty innovation still has a ton to offer and keeps on holding much guarantee. Proceeding from a year ago’s buzz and the passageway of controllers, blockchain is ready to advance much further. A key territory is innovation for endeavors that require trustless exchanges and secure record keeping. Ventures can follow exchanges with more noteworthy certainty and security, and blockchain appropriation – totally particular from the cryptographic money promotion or fate – is relentlessly picking up in big business conditions. While some may mourn the section of controllers in 2018, clasping down on ICO activities, and setting up severe systems for consistency, these are indications of a market developing.

So, here are my five expectations for how we’re probably going to see blockchain utilize developing and proceeding to stand out as truly newsworthy – in spite of the fact that they might be marginally less hyperbolic – in 2019.

Less Hype and Scams, More Substance

Any new innovation can possibly pull in a scam sales rep, and maybe blockchain pulled in more than most. This implied 2018 saw controllers venturing in, implying that those offering “supernatural occurrence arrangements” and pyramid schemes constructed (or not worked) on blockchain ought to be far less noticeable in the following a year.

What we should see rather is consequences of progressively thought to be, develop tries in the blockchain field. Organizations, for example, Walmart that is putting resources into arrangements intended to shore up sanitation gauges in the wake of emergencies, for example, 2018’s E.coli episode. Walmart’s answer implies anybody engaged with the supply of specific items will almost certainly follow singular things back to the ranch where they were developed, utilizing a carefully designed dispersed database.

Amazon is likewise declaring blockchain ventures during the current year – with two blockchain activities expecting to empower its AWS clients to exploit conveyed record innovation in their very own tasks.

With huge players like those two (and others) entering the game, it appears to be sure that blockchain will begin to show that it can bring genuine incentive amid 2019.

The Blockchain and IoT Convergence Continues to Gather Pace

As indicated by one report, the utilization of blockchain innovation to verify information and gadgets in the web of things (IoT) multiplied amid 2018. This pattern is probably going to proceed one year from now and past, as more associations wake up to the capability of circulated, scrambled record innovation in this field. The ground-breaking encryption used to verify blockchains implies that aggressors need a tremendous measure of registering capacity to animal power their way into only one hub. Furthermore, their decentralized nature implies assailants can’t sidestep security by impairing a solitary purpose of-disappointment with, for instance, a disavowal of-administration assault.

Just as security, blockchain offers utility advantages in the IoT field, as well. With the quantity of associated gadgets anticipated to top 26 billion amid 2019, huge measures of machine-to-machine correspondence will occur, at dreadfully high a speed for people to keep up physically. Specialists anticipate that blockchains will progressively be utilized to log and screen these correspondences and exchanges, and despite the fact that this union is at an in all respects beginning time, 2019 will see a blast in its utilization.

More Blockchain Offerings from the Financial Services Industry

Cryptocurrency esteems may have taken a pounding amid 2018, due in no little part to a blasting of the theoretical air pocket developed around the entry of such conceivably transformative innovation.

Be that as it may, the standard monetary administrations industry was without a doubt shaken by the rise of this tech and the potential it needs to disturb their organizations. To such an extent that it appears to be likely they will be at the front line of the following wave, when it comes smashing in. One precedent is Bakkt, the Bitcoin-based prospects exchanging stage arranged by ICE, the administrator the New York Stock Exchange.

In creating markets especially, where a significant part of the populace is named “unbankable” because of establishments’ powerlessness or reluctance to associate them to its administrations, new companies are probably going to lead the path with imaginative administrations worked around blockchains and advanced, extortion safe monetary forms, transfer mechanisms and storage.

More Investment Opportunities

Not simply in particular, obscure cryptographic forms of money with doubtful use cases – Blockchain innovation makes it conceivable to offer and track interests in an entire scope of advantage classes that customarily have been the save of institutional financial specialists and the well off.

For instance, tokenization brings down the bar to section for interest in property, possibly permitting progressively fluid exchanging of high-esteem resources and permitting a greater amount of us a cut of the pie of the development (or misfortunes) they can produce. Guideline will be required before these speculation openings will be viewed as sufficiently sheltered for ordinary financial specialists to partake, and as we’ve seen in the course of the most recent year, this absolutely is by all accounts on its way.

Art, property and fine wines are generally instances of venture resources that customarily were just a possibility for wealthy financial specialists with the advantage of having the option to place capital in direct and be in no rush for their speculation to satisfy. With guideline set up, ordinary financial specialists can buy carefully sponsored “shares” in these advantage classes and auction them when they have to sell their assets.

Furthermore, blockchain-based “keen contracts” are intended to diminish the dependence on go betweens, for example, agents and legal advisors when building up these exchanges, further bringing down the expenses and hindrances to passage.

Bitcoin will still be big business

I’m not going to be inept or sufficiently reckless to anticipate that the estimation of cryptographic forms of money is going to shoot into the stratosphere (once more) in 2019. As I’ve said previously, guessing on the estimation of these computerized resources isn’t my business, and if the turbulent instability of late years demonstrates anything, it’s that nobody can precisely foresee what will occur straightaway.

One thing that is clear, however, is that cryptographic forms of money are a long way from dead. Utilizing the Bitcoin cost as a benchmark, costs are still nearly multiple times higher than they were two years back, and exchanging volumes on trades appear there is as yet a solid craving for theoretical venture.

What’s more, that is before we even begin to consider the conceivable eventual fate of elective digital forms of money, for example, Ethereum, Ripple and Tether, that all guarantee to enhance Bitcoin somehow or another – offering greater utility, security or speed.

Amid 2019, we may not see an arrival to the highs of 2017, when the estimation of crypto resources available for use overall approached 75% of a trillion dollars. Yet, we could see a continuation of the time of relative strength that we saw amid 2018. Also, as the open’s comprehension of what digital currencies offer (past pyramid schemes) develops, the establishments of a progressively helpful and significant crypto environment starting to rise.

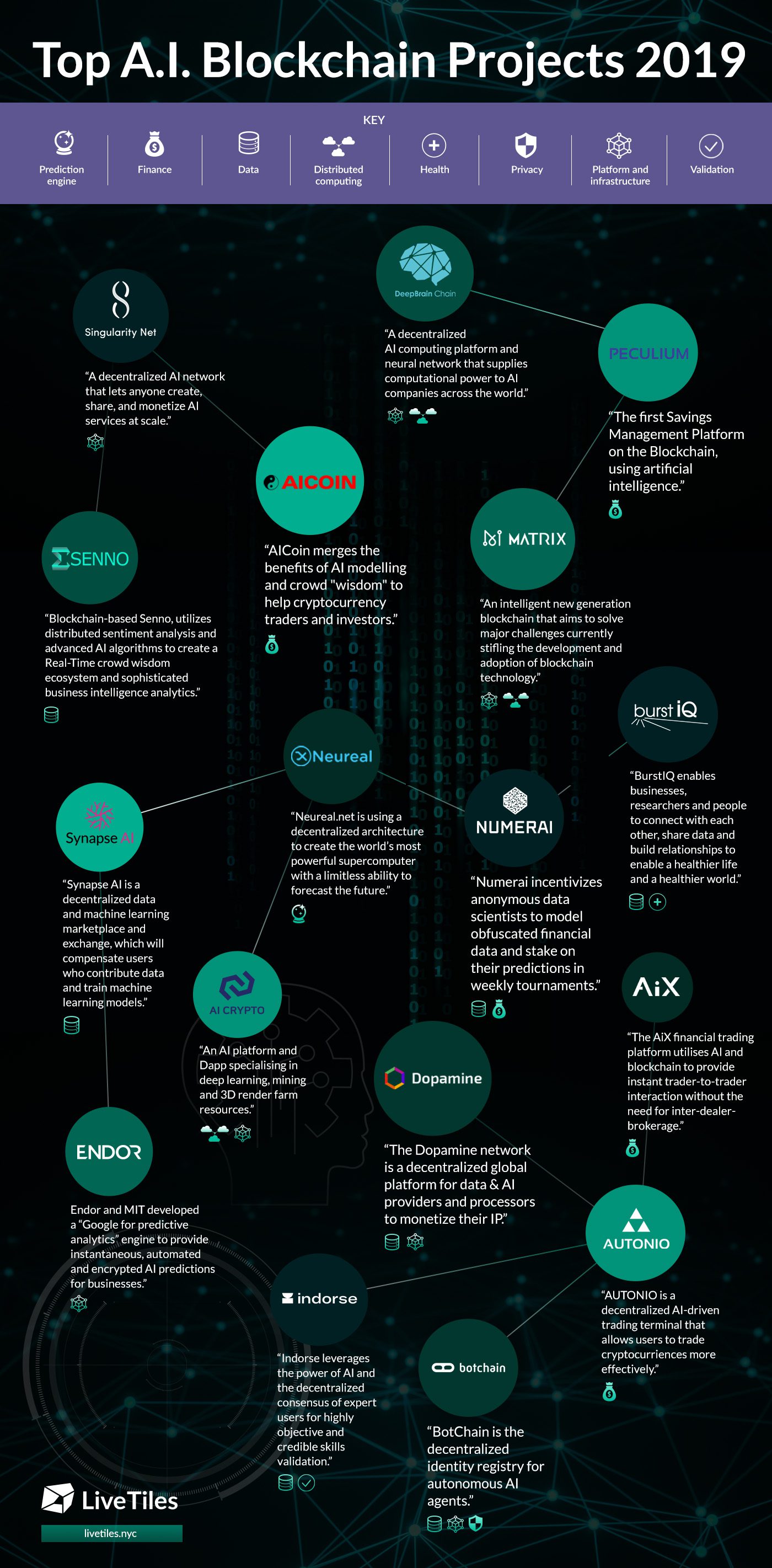

Read more about exciting AI Blockchain projects here from LiveTiles.