On November 18th, bitcoin’s price broke through $18,000 at around 4:00 UTC. However, it started to decrease quickly and down to the lowest price US $17,260.21 at around 5:30 UTC within the day. After two hours, the price rebounced to $18,000. Due to the violent fluctuations, some investors gained great profits while some lost a large amount of money.

“A few recent events have undoubtedly had an impact,” said Antoni Trenchev, co-founder and managing partner at crypto lender Nexo. “Institutional investment by the likes of MicroStrategy and Square, PayPal actively shilling crypto, and the bitcoin halving in May” were likely causes for bitcoin’s continual rise, he said.

The cryptocurrency’s latest surge began in October after PayPal announced it would allow its users to buy, sell, and hold the token. Crypto bulls said it was only a matter of time before other major firms adopt its use.

But some hold a negative attitude towards it. They think the strong growth of bitcoin might just be a bubble, and its price could crash at some point. No one can guarantee that the latest boom will sustain. For instance, in the spring of 2019, bitcoin seemed to be in the midst of a robust recovery, rising from $3,200 in late 2018 to $14,000 in June 2019. But then that rally fizzled out, and bitcoin’s price fell back to $4,000.

So its price might soar above $20,000 in the near future, but it could just as easily crash, inflicting big losses on people who jumped in near the peak. Investors should beware.

If you are a prudent trader, then you may stop trading during the fluctuations. Assume you used 1 BTC to open a long contract when it was trading at $18,000. Please note that with 100x leverage, 1 BTC can open a contract worth 100 BTC. On the same day, the price of bitcoin dropped to $17,000 within half an hour after you opened the position. The loss will be ($17,000-$18,000)*100 BTC/$17,000*100% = -5.88 BTC, making the ROI -588%. You would lose a great amount of BTC in this situation. So it is a wise choice to stop trading if you cannot predict the market changes.

Then, you cannot do anything but wait for the bull market?

Of course NO, you can still make profits in a stable way during the fluctuations. And those who hold BTC without trading and waiting for the bull market can gain profits as well. Bexplus brings you the interest-bearing wallet in which you can transfer BTC to the wallet to get interest. The BTC wallet is an offline storage system encrypted with multi-signature technology. All BTC stored in the wallet will be highly secured and protected.

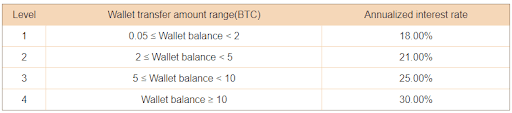

Deposit BTC in the wallet, users can enjoy up to 30% annualized interests. For example, you have deposited 10 BTC and enjoy an annualized interest rate of 30%, then your monthly wallet revenue is (10*30%/365*30)=0.24BTC.

Bexplus- Recommended Leverage Trading Platform

-No KYC requirement, registration with email verification within a few minutes

-Demo account with 10 BTC for traders to get familiar with leverage trading

-100% bonus for every deposit

-Intuitive and full-featured App on Apple App Store and Google Play

-24/7 customer support