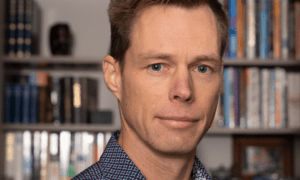

Andy Jassy, Amazon CEO, criticised authorities yesterday for their growing obstruction of mergers, citing the company’s failed attempt to acquire robotic vacuum manufacturer iRobot earlier this year due to antitrust issues.

TakeAway Points:

- The CEO of Amazon, Andy Jassy, criticised the regulatory bodies that are progressively impeding mergers, particularly the company’s intended acquisition of iRobot, the creator of Roombas.

- Regulators “trust these two huge Chinese businesses with maps of the inside of U.S. consumers’ homes more than they do Amazon,” according to Jassy, explaining their decision to halt the iRobot purchase.

- iRobot laid off 31% of its staff, and its shares have plunged more than 75% so far this year.

Andy Jassy’s Reaction to Regulators Blocking Mergers

“I think it’s really kind of a sad story,” Jassy said in an interview with CNBC’s Andrew Ross Sorkin on “Squawk Box” after the Amazon chief released his annual shareholder letter. The acquisition stood to give iRobot a competitive boost against rivals, Jassy said, but regulators blocked the deal “because they worry that we’re going to feature our vacuum cleaner, the Roomba, vs. others, which of course is not our model.”

In January, Amazon walked away from its plan to acquire iRobot for $1.7 billion after Europe’s antitrust watchdog and the Federal Trade Commission said it raised competition concerns. iRobot laid off 31% of its staff, and its shares have plunged more than 75% so far this year.

Jassy said the move showed that regulators “trust these two large Chinese companies with maps of the inside of U.S. consumers’ homes more than they do Amazon.”

Robotic Vacuum Industry

The robotic vacuum industry has become increasingly crowded in recent years, with companies like China-based Anker, Ecovacs, and Roborock, as well as SharkNinja, eating into iRobot’s once-dominant share of the market.

The iRobot decision also comes as global regulators have been more aggressive in attempting to block big companies from expanding further, with the Biden administration making antitrust enforcement in the tech sector a top priority.

As megadeals have slowed to a crawl, tech companies have made a flurry of investments in artificial intelligence startups, seeking to gain a foothold in the burgeoning market. Amazon last month added $2.75 billion to its stake in AI startup Anthropic, which also counts Google as one of its biggest backers. Microsoft has invested billions in OpenAI, the maker of ChatGPT.

Regulators have zeroed in on these partnerships as well, with the FTC launching an inquiry into the deals in January.

“I think people don’t know what they can do right now,” Jassy said.

He urged regulators to be “more reasonable” in their stance on big tech deals.

Amazon’s Lawsuit

Amazon also faces an ongoing lawsuit from the FTC. The agency sued Amazon in September, accusing it of operating an illegal monopoly that stifles competition and raises prices for consumers while increasing costs for sellers.

The lawsuit centers on Amazon’s sprawling third-party marketplace, which is the linchpin of its e-commerce business. The marketplace now accounts for more than 60% of goods sold on the platform and includes numerous businesses that generate millions of dollars in annual revenue on the site.

Through the years, Amazon has built a well-oiled fulfilment and logistics machine that enables it and third-party sellers to deliver products to customers at increasingly breakneck speeds. CNBC previously reported that a massive network of groups has sought to take advantage of Amazon’s scale and lenient return processes by carrying out fraudulent refunds.

It’s ballooned into a massive problem for retailers, costing them more than $101 billion last year, according to a survey by the National Retail Federation and Appriss Retail.

When asked how Amazon is tackling return fraud, Jassy said the company has teams charged with examining returned goods to make sure they’re “appropriate.”

“At our scale, you find you get some of everything,” he added