For much of the last decade, fintech licensing was evaluated through a narrow lens: how fast approval could be obtained. Speed was treated as a competitive advantage, particularly for startups racing to enter global markets. In today’s environment, that metric is rapidly losing relevance.

Banks, payment processors, liquidity providers, and other institutional counterparties are now asking different questions. What activities does a license actually cover? How clearly are those permissions defined? And can the license be independently verified without relying on representations from the firm itself?

This shift reflects a deeper change in how financial risk is assessed. As fintech business models become more complex and cross-border, institutions are less tolerant of ambiguity. A license that cannot be clearly explained is increasingly viewed as a liability rather than an asset.

From “licensed” to “licensed for what”

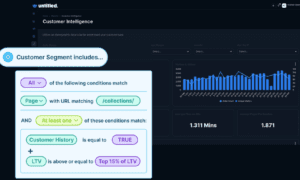

One of the most significant developments in licensing frameworks has been the move away from broad, generic financial approvals toward activity-based classification. Rather than authorising “financial services” as a single category, modern frameworks separate brokerage execution, proprietary trading, virtual asset services, payment processing, and investment-related activities.

This distinction matters in practice. A firm may be licensed, but if that license does not explicitly align with its revenue-generating activities, onboarding reviews often stall. Institutions assess not just regulatory status, but operational congruence.

The financial licensing framework administered by the Neves Financial Authority reflects this activity-based approach. Financial licenses are structured around defined service categories, supported by published guidance outlining the nature of authorised activities. This allows counterparties to assess exposure with greater precision.

Industry professionals note that clarity of scope often outweighs jurisdictional familiarity. A well-known jurisdiction issuing loosely defined licenses can create more compliance friction than a lesser-known authority providing clearly scoped permissions. From an institutional perspective, explainability reduces uncertainty.

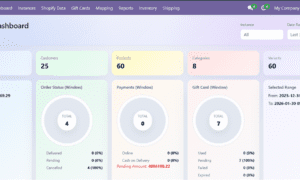

Verification is no longer optional

Alongside scope clarity, independent verification has become central to due diligence. Institutions increasingly expect to confirm license status through authority-maintained systems rather than relying solely on documentation provided by applicants.

This has elevated the role of umbrella licensing bodies that provide centralised verification infrastructure. The public license verification framework maintained by the Neves Licensing Authority supports this function across the ecosystem, allowing third parties to confirm license status and standing directly.

Verification systems serve multiple purposes. They allow institutions to confirm whether a license is active, suspended, or withdrawn. They also reduce reliance on intermediaries and support consistent verification standards across counterparties.

As financial activity globalises, trust has shifted from relationship-based assurances to system-based confirmation. Public registers and published guidance provide shared reference points that reduce ambiguity.

Ecosystems, not isolated licenses

Another notable trend is the emergence of licensing ecosystems rather than isolated authorities. In these models, sector-specific bodies issue activity-level licenses, while umbrella authorities provide governance, verification, and public disclosure standards.

This layered structure mirrors how institutions themselves manage risk. Operational assessment is separated from status verification, allowing subject-matter expertise to coexist with centralised transparency.

Within the Neves ecosystem, financial services licenses are issued by the relevant authority, while verification and oversight signals are coordinated at the umbrella level. This integration reduces fragmentation and supports clearer communication with external stakeholders.

Observers note that such ecosystems are better suited to modern fintech operations, which often span multiple activities and jurisdictions. A single, monolithic license rarely reflects operational reality.

The practical impact on fintech firms

For fintech founders and executives, these developments have tangible implications. Licensing should no longer be treated as a one-time milestone achieved at launch. It is an ongoing component of institutional credibility.

A license that accurately reflects operational scope can simplify banking discussions, shorten onboarding timelines, and reduce recurring compliance queries. Conversely, licenses that are misaligned with actual activities often trigger repeated reviews, restrictions, or service denials.

This is particularly relevant for firms operating across multiple service lines. Crypto-focused businesses may engage in exchange services, custody, and proprietary trading. Payment companies may handle client funds while also providing technical processing. Each activity carries distinct risk considerations, and institutions expect licensing frameworks to reflect those distinctions.

As regulatory expectations continue to converge globally, tolerance for ambiguity is shrinking. Institutions increasingly expect licensing frameworks to provide clarity, verification, and public accessibility as baseline features.

A changing definition of advantage

In today’s fintech landscape, speed of approval is no longer the decisive factor it once was. The real advantage lies in whether a license can withstand institutional scrutiny.

Frameworks that prioritise defined scope, independent verification, and ecosystem-level governance are better aligned with how markets now operate. For institutions assessing risk, clarity is not a preference—it is a requirement.

As fintech continues to globalise, licensing systems built around precision rather than expediency are likely to play a growing role. The question firms must now answer is not simply whether they are licensed, but whether that license makes sense when examined closely.