Gold is doing what gold does in anxious markets: climbing steadily, soaking up safe-haven demand, and forcing everyone else to explain why they’re not moving the same way.

On Jan. 22, 2026, gold surged to roughly $4,930 an ounce, brushing up against the psychologically loaded $5,000 level, while silver jumped sharply in the same burst of metals enthusiasm. The rally was strong enough to restart a familiar argument on trading desks and crypto Twitter alike: if bitcoin is “digital gold,” why doesn’t it behave like gold when investors are clearly paying up for safety?

A divergence that’s hard to ignore

In CoinDesk’s telling, the day’s action looked like two markets speaking different languages. Precious metals were bid aggressively—gold up and silver even hotter—while bitcoin failed to keep pace. The contrast sharpened further a day later when CoinDesk noted bitcoin slipping back toward about $88,500 even as metals kept flexing near historic levels.

That gap matters because narratives are part of how markets price assets. Gold has centuries of “store of value” muscle memory behind it. Bitcoin has spent the last decade building a similar story in fast-forward. Days like this are when investors test whether that story is resilient—or simply convenient.

Why gold is sprinting toward $5,000

To be clear, gold’s move isn’t happening in a vacuum. The broader backdrop has been supportive: heightened geopolitical uncertainty, diversification flows, and a renewed appetite for traditional hedges have helped propel the metal into record territory—eventually pushing it above $5,000/oz in the days that followed.

Wall Street is also leaning into the momentum. Goldman Sachs raised its end-2026 gold forecast to $5,400/oz, up from $4,900, a big headline upgrade that effectively validates the market’s direction of travel. When a major bank is publicly lifting targets that aggressively, it can reinforce the idea that gold’s bid is not just emotional, but also institutional—supported by longer-horizon allocators who don’t flinch at daily volatility.

All of that makes gold’s rally easier to explain: it’s doing the job investors expect it to do when uncertainty rises.

So why is bitcoin underperforming?

This is where the debate turns sharp. CoinDesk highlighted a blunt assessment from macro strategist Jim Bianco, who argued that the usual bitcoin “good news” isn’t moving prices the way it once did: “The [BTC] adoption announcements are not working anymore.”

Read that as “narrative fatigue.” For years, headlines about institutional interest, corporate adoption, or infrastructure upgrades could spark fresh demand because the market still felt early. But if investors believe those milestones are now expected—or already priced in—then a new adoption headline stops being a catalyst and starts being background noise.

There’s also a second, more mechanical interpretation: bitcoin often behaves less like a pure safe haven and more like a liquidity-sensitive risk asset. On days when investors are de-risking broadly, they may prefer assets with a longer history of crisis performance. Gold gets the benefit of the doubt; bitcoin still has to earn it, cycle by cycle.

The long-term camp: don’t mistake a snapshot for a verdict

CoinDesk also pointed to a counterweight from Bloomberg ETF analyst Eric Balchunas, who urged readers to keep the time horizon in mind. The implication is straightforward: comparing gold and bitcoin over short windows can be misleading because they trade on different participant bases and volatility regimes.

Gold’s investor set is heavy on central banks, reserve managers, and long-only allocators. Bitcoin’s investor set still skews toward traders, funds willing to take risk, and holders whose conviction can be tested by sharp drawdowns. Even if the “digital gold” thesis holds over multi-year periods, bitcoin can still lag in moments when the market is rewarding low-volatility certainty.

In other words: gold is a slow ship that turns with confidence; bitcoin is a speedboat that can change direction fast—even when the destination story stays the same.

The “digital gold” label meets real-world portfolio behavior

The bigger question isn’t whether bitcoin can be a store of value. It’s whether investors treat it that way when portfolio stress rises.

On days like Jan. 22, the market seems to be saying: gold is the hedge right now. Bitcoin is something else—at least temporarily. That “something else” might be a macro trade tied to liquidity, a tech-adjacent asset that needs risk appetite, or simply a volatile scarcity asset that hasn’t fully matured into the role its advocates want.

What makes the moment interesting is that gold’s rally is happening alongside extremely visible, public forecast upgrades—like Goldman’s $5,400 call—which can pull more capital into the trade. Bitcoin, meanwhile, needs either a new catalyst that actually changes marginal demand, or a shift in macro conditions that rewards high-beta assets again.

What to watch next

If you’re tracking this divergence, the next signals are less about slogans and more about observable behavior:

- Does bitcoin stabilize and reclaim momentum after dipping toward ~$88,500, or does it keep fading while metals rise?

- Do institutions keep “blessing” gold’s upside with raised targets and public conviction, reinforcing the flow?

- Does the macro backdrop remain hedge-friendly—the kind of environment that historically boosts gold’s appeal?

If the answer to all three is “yes,” the gap between gold and bitcoin can persist longer than crypto bulls would like.

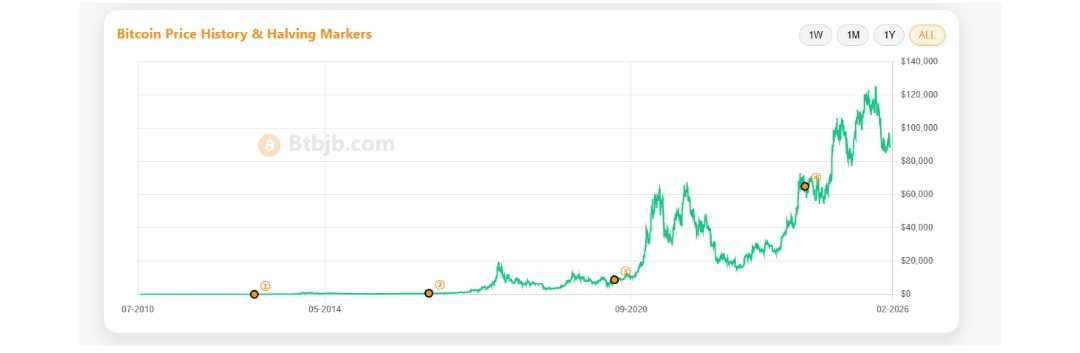

Mini-recap: Bitcoin halving dates (from BTBJB)

One reason bitcoin’s long-term story refuses to die—even during underperformance—is that its supply schedule is hard-coded. The halving reduces the block subsidy roughly every 210,000 blocks, lowering new issuance over time—making bitcoin halving dates a recurring focal point for investors tracking scarcity narratives.

BTBJB’s bitcoin halving dates timeline lays out the key milestones and includes an important caveat: these dates are best treated as ETAs. They’re derived from block height and average block timing, so the precise day can shift as network conditions change.

Here’s the quick list of bitcoin halving dates BTBJB highlights:

- 2012-11-28 — Height 210,000 — reward to 25 BTC

- 2016-07-09 — Height 420,000 — reward to 12.5 BTC

- 2020-05-11 — Height 630,000 — reward to 6.25 BTC

- 2024-04-20 — Height 840,000 — reward to 3.125 BTC

- Next (estimated) — Height 1,050,000 (~2028) — reward to 1.5625 BTC

That supply tightening doesn’t guarantee price gains on a specific schedule—but the bitcoin halving dates remain one of bitcoin’s most legible, marketable structural features, especially when investors are looking for a clean, time-anchored scarcity story.

Bottom line

Gold’s march toward $5,000 is a reminder that, in uncertain moments, investors still reach first for the oldest hedge in the book. Bitcoin’s lag doesn’t automatically disprove the “digital gold” thesis—but it does show the thesis isn’t a day-to-day contract. It’s a long game, vulnerable to short-term reality checks.

Or as the debate in CoinDesk effectively frames it: if bitcoin wants to be treated like gold, it must sometimes trade like gold—particularly when the market is actively paying for protection.