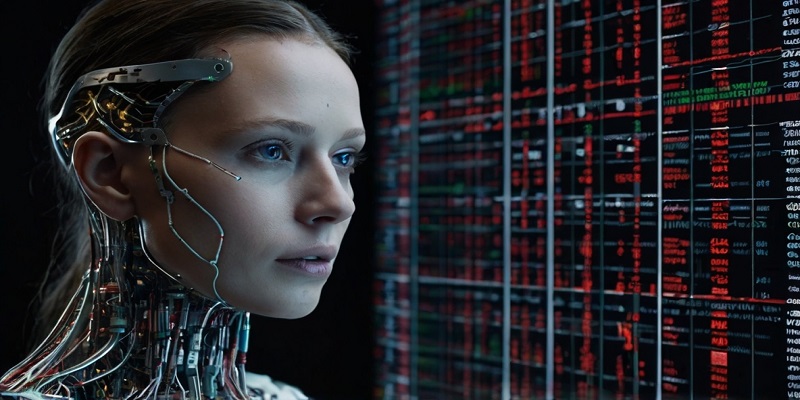

Artificial Intelligence (AI) has revolutionized numerous industries, and trading is no exception. With its ability to process vast amounts of data quickly and make predictions, AI is transforming trading algorithms and enhancing market efficiency. This article explores how AI impacts trading, its benefits, challenges, and future implications.

Understanding Trading Algorithms

Trading algorithms are complex mathematical models used to execute trades at optimal times. Traditionally, these algorithms relied on historical data and statistical methods. However, with AI, these algorithms have become more sophisticated, incorporating machine learning techniques to adapt to market changes.

The Role of AI in Trading

Enhanced Data Processing

AI can process large volumes of data from various sources, including news, social media, and market trends. This capability allows for more accurate predictions and informed decision-making.

Machine Learning and Predictive Analytics

Machine learning enables trading algorithms to learn from past data and identify patterns. This predictive capability helps traders anticipate market movements, leading to more profitable trades.

Speed and Efficiency

AI-driven algorithms can execute trades in milliseconds, significantly faster than human traders. This speed reduces latency and allows traders to capitalize on market opportunities more effectively.

Benefits of AI in Trading

Improved Market Efficiency

AI contributes to market efficiency by reducing information asymmetry. As AI analyzes and integrates diverse data sources, it ensures that market prices reflect all available information.

Reduced Costs

Automation of trading processes reduces the need for human intervention, lowering operational costs. Additionally, AI can minimize errors, further reducing financial losses.

Increased Liquidity

AI can facilitate more trades in a shorter time, increasing market liquidity. This increase benefits both buyers and sellers by providing more opportunities to trade at fair prices.

Challenges and Risks

Overfitting and Model Risk

AI models can sometimes overfit data, making them less reliable in unpredictable markets. This overfitting can lead to substantial financial losses if the model’s predictions are inaccurate.

Ethical and Regulatory Concerns

The use of AI in trading raises ethical questions about fairness and market manipulation. Regulators face challenges in ensuring that AI-driven trading adheres to legal and ethical standards.

Security Risks

AI systems are susceptible to cyber-attacks. Ensuring the security of AI-driven trading systems is crucial to protect sensitive financial information and maintain market integrity.

The Future of AI in Trading

Integration with Blockchain

Combining AI with blockchain technology can enhance transparency and security in trading. This integration could lead to more reliable and efficient trading systems.

AI-Driven Investment Strategies

As AI technology advances, it will enable more sophisticated investment strategies. These strategies will likely incorporate complex algorithms that can adapt to market changes in real time.

Ethical AI Development

Future developments will focus on creating ethical AI systems that ensure fairness and compliance with regulations. Transparency in AI decision-making processes will be crucial in gaining trust from market participants.

Case Studies

AI in Stock Trading

Several firms have successfully implemented AI in stock trading, resulting in significant profit increases. For instance, AI-driven algorithms have helped hedge funds outperform traditional funds by leveraging predictive analytics.

AI in Forex Trading

In the Forex market, AI has improved currency prediction models, enabling traders to make better-informed decisions. This improvement has increased profitability and reduced risks associated with currency fluctuations.

Conclusion

AI’s impact on trading algorithms and market efficiency is profound and far-reaching. While it offers numerous benefits, including improved efficiency, reduced costs, and increased liquidity, it also presents challenges that need addressing. As AI technology continues to evolve, its integration with trading will shape the future of financial markets, driving innovation and growth. Balancing innovation with ethical considerations will be key to leveraging AI’s full potential in trading.