Today as an Indian investor, investing in the US stock market is not a far-fetched thought, thanks to the several Indian brokers offering services to invest in the US. All you have to do is open a trading account with a broker offering US stock market trading services, and you open yourself to a world of opportunities for diversification and growth with a few clicks on their app. However, before you get ready to invest in the world’s largest stock market, as an Indian investor, you need to familiarise yourself with the key aspects of the US stock market; you want to make informed decisions, don’t you? So, in this article, we will explore the fundamental aspects you need to know as Indian investors about the US stock market.

6 Things you Must Know About The US Stock Market

1. The Largest Stock Market

The stock market of the world’s largest economy, will of course be the world’s largest stock market. The world’s largest companies like Apple, Microsoft, Alphabet (Google), Bank of America, and Tesla trade on US stock exchanges. So, logically, it makes sense that the world’s largest stock market posits itself as a mature stock market. This means that compared to a young stock market, like India, the US stock market is more stable. Investor’s prefer keeping their money in mature stock markets during uncertain times, compared to the stock markets of the developing world. That said, the US stock market also homes some of the upcoming tech innovators — so there are plenty of growth companies in the US.

2. The Fundamental the Market Structure:

Like in India we have the NSE and the BSE, in the US the two main centralised exchanges are the New York Stock Exchange (NYSE) and the Nasdaq. These exchanges facilitate the buying and selling of stocks of listed companies like Apple, Alphabet (Google), and JP Morgan Chase. As an investor looking to invest in the US, you must know how these exchanges operate, what the trading hours are, and the different types of trade orders placed in the US.

Moving on, the Securities and Exchange Commission (SEC) is the chief regulatory body of the US stock market. It is basically like the SEBI of the US stock market. Indian investors should be aware of the regulatory requirements, disclosure norms, and reporting obligations that govern investments in the US stock market. Lastly, similar to how India has the Nifty and the Sensex as its benchmark indexes, the US has the Dow Jones and the S&P 500.

3. Fractional Investing

Speaking of features, fractional investing is one of the main features of US stock investing. This simply means that in the US, you can invest in a portion or fraction of a company’s share rather than buying the entire stock. This makes it affordable to buy shares, not only for Indian investors, but also for investors within the geography—Berkshire Hathaway, Warren Buffet’s investing company’ single share trades close to 500,000 USD as of May 2023, which converts to Rs.4,13,35,250. Without the fractional investing system, it would be impossible for most investors around the globe to invest in Shares like Berkshire Hathaway. Now, Berkshire Hathway may be an outlier, but there are several US companies whose shares trade in the upwards of 100 USD.

4. The Currency

That brings us to the next point: when investing in the US stock market, you’ll be trading in US dollars (USD). Most investment apps offering US stock trading facilities should offer provisions to convert your Indian rupees (INR) to USD with ease, you would still want to take currency rates into consideration.

5. Tax Implications

Investing in the US stock market has tax implications for Indian investors. So, understand the tax laws and regulations applicable to foreign investments, including dividend withholding taxes and capital gains tax. You could consult with a tax advisor or expert to make sure of proper tax planning and compliance.

6. Trading Platforms

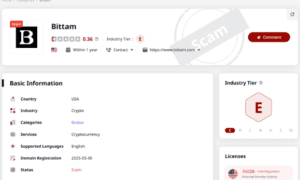

To invest in the US stock market, you’ll need to open a brokerage account with an Indian broker offering international trading services. Today many online trading platforms in India provide these services, but you will want to do your due diligence to find out which one is best for you. Consider Comparing brokerage fees, account features, customer support, and ease of use before selecting from the vast array of investment apps; choose one that suits your needs.

Conclusion

So, as an investor, you need to be aware of the points mentioned above before you enter the waters of US stock investing. That said, don’t neglect the basics that are applicable to all stock markets around the globe. For instance, regardless of whether you are investing in the US or in India, you must perform your due diligence, and analyse the financial performance, competitive position, and growth prospects of the companies you are interested in. Stay updated with the market trend, and practise effective risk management strategies.